Week in Review

Markets struggled to regain ground lost in the middle of the week, with prices opening at $66.18, following as low as $63.67 on Wednesday, and surging back to over $66 again in early morning trading. After profit-taking early in the week, reported fuel stock draws helped to send the market higher, despite the first inventory build since early November.

As we’ve noted, markets are showing overall less slack in the supply chain – with inventories at multi-year lows and balanced supply/demand worldwide, any perceived risk of outages or outsized demand will cause oil to rise. The latter of these, robust global demand, is the current market focus – with every major economy rising in sync, global growth (and resulting fuel demand) should be robust in 2018.

For months, crude prices have been rising rapidly, growing from just $43 in July to over $65 today – a 51% rise over seven months. This week, prices stagnated, bouncing off a $66.50 ceiling on Monday and struggling to regain that level. Prices are within striking distance of closing higher, with prices opening at $65.99 this morning.

Crude was pulled higher this week despite a bearish inventory report from the EIA, which showed a larger-than-expected stock build. But despite the build, crude stocks fell overall in January, which has given markets optimism about the rest of the year.

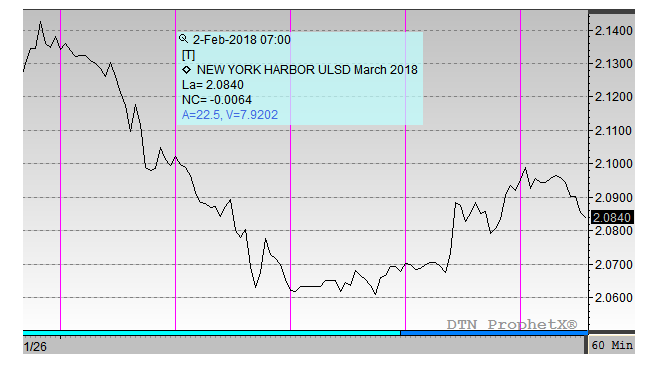

Diesel prices began the week much like crude oil, with significant losses after peaking on Monday. However, diesel prices have struggled to regain what they lost. Diesel prices have remained above $2.00/gal for all of 2018 so far. Relative to crude oil, though, diesel spreads (the price of one barrel of diesel less the cost of a barrel of crude oil) has fallen this week from the $23-$25 range enjoyed since September down to below $22. Falling diesel crack spreads suggest that the strong pressure on diesel supplies is wearing down.

Like diesel prices, gasoline prices have stagnated this week. Prices rose almost to $1.95 early in the week, but profit-taking in crude markets caused gasoline products to lose their value as well. Prices opened this morning just slightly above $1.90, well below their $1.94 opening price for the week.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.