Today’s Market Trend

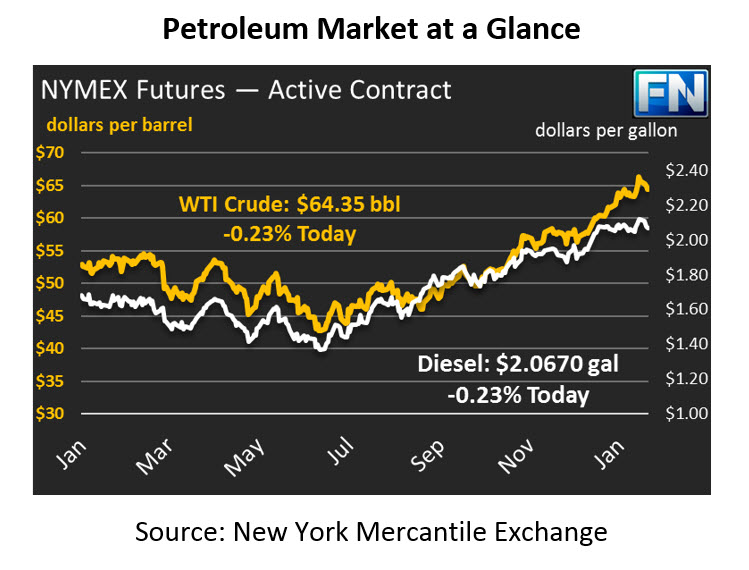

Oil markets sustained further losses yesterday. Crude prices fell over a dollar to end the day at $64.50, continuing what is now a three-day losing streak. Markets are still falling this morning, with crude prices currently trading down 15 cents at $64.35.

Refined products are also strongly in the red, and the past two sessions have brought the biggest two-day losses of the year, with diesel prices shedding 6.8 cents while gasoline shed 4.8 cents. Diesel prices are trending slightly down this morning, with prices down 0.5 cents at $2.0670. Gasoline, on the other hand, is continuing its freefall with 2.2 cent losses again today, trading at $1.8730.

The API released its weekly inventory numbers, and the results have been firmly bearish for markets. Crude finally (maybe) saw a stock build, while gasoline builds exceeded expectations. Keep in mind that last week, the API announced a crude inventory build, only for the EIA to show a crude draw. If crude stocks truly rose this week, it will be the first stock build since November 10. January inventories typically rise, so this season has bucked the trend and yielded the largest January draw since 2000.

While the fundamentals remain strong, markets are beginning to react to the normal winter slowdown in demand. Refineries often use the first few months of the year for planned maintenance and improvements, reducing the call for crude. Because the trend is seasonal, there’s no reason to think current inventory builds would be decidedly bearish for prices, but markets tend to react to headlines before correcting back to the fundamentals. Right now, markets are taking risk out of the market, which has brought prices lower as some traders exit the market.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.