Today’s Market Trend

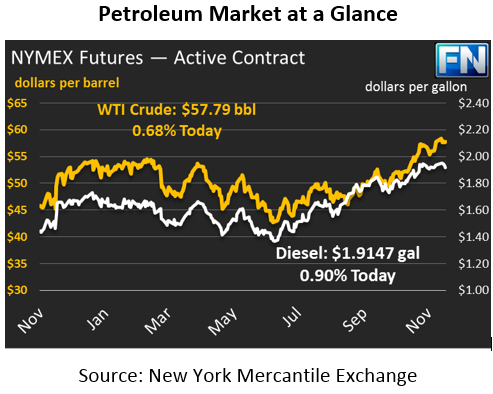

Oil prices move higher this morning after OPEC’s announcement yesterday that cuts will be extended through 2018. Crude traded mostly flat during yesterday’s session, closing just 1 point lower than its opening price. Prices have strengthened slightly this morning, gaining 39 points (.68%) to trade at $57.79.

Refined product markets are following crude higher, with Diesel leading the way. Diesel prices are trading at $1.9147 this morning, a gain of 1.7 cents (0.9%) after experiencing a loss of nearly 3 cents during yesterday’s session. Gasoline saw much smaller losses yesterday, only 36 points compared to diesel’s loss of 2.98 cents. Gasoline restored its minor losses this morning gaining 85 points (.49%) to trade at $1.7385.

The markets anticipation of the OPEC announcement was eased yesterday, though having little effect on prices since the outcome was already priced into the market. However, OPEC announced that Libya and Nigeria will be participating in the deal beginning in January. Both countries were previously exempt from production cuts due to internal issues. A collective production cap of 2.8mmbpd has been added, which is very close to current production levels of 1.74mmbpd for Nigeria and 0.96mmbpd for Libya.

With the announcement that the cuts will continue, attention is again turned to U.S. shale production. Reuters reported that Asia, the largest consumer region in the world, has already increased inquiries and orders from the Gulf of Mexico and the Caribbean – particularly from the United States, Venezuela, Columbia, and Mexico. Some market experts predict that OPEC’s cuts will result in lost market share for OPEC and Russia in Asian markets.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.