Exchange-Traded Funds Play an Increasing Role in Oil Futures Markets

Editor’s Note: Many of the factors impacting oil prices are as old as the commodity market itself: inventories, production, demand, economic growth, etc. One newer factor influencing prices is the stock market through ETFs. Rising ETFs volumes are adding length to the market, which is reflected in the CFTC’s reports. Those CFTC reports are showing record high length in the market, and ETFs are one contributing factor adding to high volumes.

Although exchange-traded funds (ETF) are relatively new, their increased positions of oil futures contracts in recent years may have, at times, affected market liquidity and price volatility. ETFs allow smaller capitalized investors indirect access to the oil futures market. Their growth has likely contributed to the increased volume in crude oil futures trading and the number of outstanding contracts (open interest), but the effects on price direction are unclear.

ETFs function similarly to a mutual fund or commodity pool in which investors purchase shares of a fund that holds assets such as equities, bonds, commodities, or futures contracts. Many energy ETFs buy and sell oil futures to serve as underlying assets that support the value of the ETF shares. The fund manager issues blocks of ETF shares to Authorized Participants—typically institutions that facilitate trading liquidity—that then sell individual ETF shares to investors. Because shares of ETFs trade the same way that shares of stock trade on exchanges, such as the New York Stock Exchange, commodities such as crude oil that trade on futures exchanges become indirectly available to investors through ETFs.

The U.S. Commodity Futures Trading Commission (CFTC) requires all holders of futures contracts that exceed a certain threshold to report their holdings weekly, which are aggregated in the CFTC’s Commitments of Traders (COT) report. The COT report for November 7, 2017 identifies the classes of traders for all outstanding West Texas Intermediate (WTI) crude oil futures contracts as of that date (Figure 1). The fund manager of a commodity ETF is classified in the COT report under the Money Manager category because they are registered commodity pool operators engaged in managing and conducting organized futures trading on behalf of clients.

In a futures market, a long position means the holder bought futures contracts, whereas a short position means the holder sold futures contracts. Total long contracts must equal total short contracts because every buyer must have a seller. Most market participants do not settle their contracts with physical delivery of crude oil, rather they buy or sell futures before the contract expires to offset their initial positions.

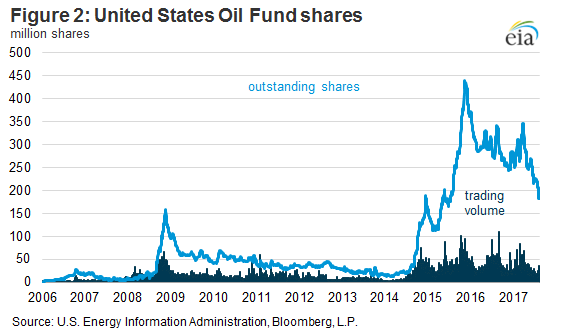

The largest crude oil ETF by total assets is the United States Oil Fund (USOF). USOF’s objective is to track the daily percent changes in front-month WTI futures contracts before fees and expenses. As public interest in USOF has increased in recent years, it created more ETF shares for Authorized Participants to offer to the public for trading. USOF has approximately 200 million outstanding shares, 15 million of which trade daily (as of November 14, Figure 2). Because the value of the shares is backed by crude oil futures contracts, increases and decreases in the number of shares outstanding have a direct effect on the number of contracts the fund holds.

The largest crude oil ETF by total assets is the United States Oil Fund (USOF). USOF’s objective is to track the daily percent changes in front-month WTI futures contracts before fees and expenses. As public interest in USOF has increased in recent years, it created more ETF shares for Authorized Participants to offer to the public for trading. USOF has approximately 200 million outstanding shares, 15 million of which trade daily (as of November 14, Figure 2). Because the value of the shares is backed by crude oil futures contracts, increases and decreases in the number of shares outstanding have a direct effect on the number of contracts the fund holds.

In recent years, as the fund has created more shares, USOF purchased more WTI futures contracts and has held as much as 20% to 25% of the open interest in front-month futures. When the fund has redeemed shares, it reduced its holdings of front-month crude oil futures to as few as 1% to 3% of the open interest (Figure 3). The ETF also makes regular purchases of second-month WTI crude oil futures and sells front-month futures a few weeks before expiration. These regular sales and purchases occur over a four-day period, which changed from a one-day set of transactions in 2009 to address concern that large trades on a single day were affecting price volatility.

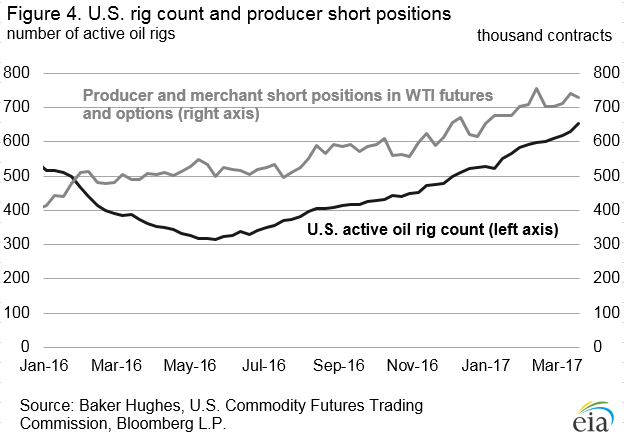

The growth in open interest and trading volume in WTI contracts has not been exclusive to first-month and second-month crude oil futures, suggesting that other types of traders have also increased futures trading (Figure 4). However, growth in ETF investing has contributed to the increase in open interest and trading volume in WTI futures contracts and will likely continue to influence crude oil futures markets as investor interest in energy commodities changes.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.