Nat Gas News – November 13, 2017

Nat Gas News – November 13, 2017

U.S. Natural Gas Prices Rise as Traders Reassess Gloomy Outlook: Kemp

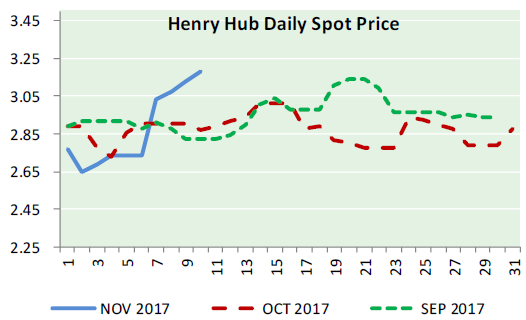

Reuters reported: (John Kemp is a Reuters market analyst. The views expressed are his own.) LONDON (Reuters) – U.S. natural gas prices have bounced by almost 10 percent since the start of the month as traders reassess their earlier bearish view this winter amid signs sentiment had become far too gloomy. Futures prices on the New York Mercantile Exchange for gas delivered to Henry Hub in January 2018 have risen to almost $3.30 per million British thermal units from $3.00 on Nov. 1. Prices for January, at the height of the winter heating season, now command a premium of almost 32 cents over April, up from just 16 cents at the start of the month. Portfolio managers held just 1.58 long positions for every short on Oct. 31, compared with 2.93 on Sept. 19, and the lowest ratio for almost a year. But there appears to have been a reappraisal since the start of the month amid signs this positioning had overshot on the bearish side. For more information visit reuters.com or click http://reut.rs/2hnTTVk

Chinese Investment Could Begin to Pay off Within a Year

The Exponent Telegram reported: CHARLESTON — After news broke that state officials had brokered an $83.7 billion deal with China Energy Investment Corporation to invest in West Virginia’s shale gas and chemical industries, one of the first questions to come up was how soon the Mountain State might see the fruits of the agreement. According to U.S. Sen. Shelley Moore Capito, R-W.Va., Thrasher and others familiar with the memorandum of understanding, ground could be broken within six to eight months on two gas-fired power stations to take advantage of the state’s vast Marcellus Shale gas reserves. Exploitation of the gas field has been hampered by a lack of infrastructure for getting the state’s natural gas to market. But that all could change with the memorandum signed Thursday in front of U.S. and Chinese Presidents. For more visit theet.com or click http://bit.ly/2zBCxic

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.