Weekend Summary

Have an article worth sharing? Send it to FUELSNews@mansfieldoil.com, and we’ll share it next week in our Weekly Summary segment.

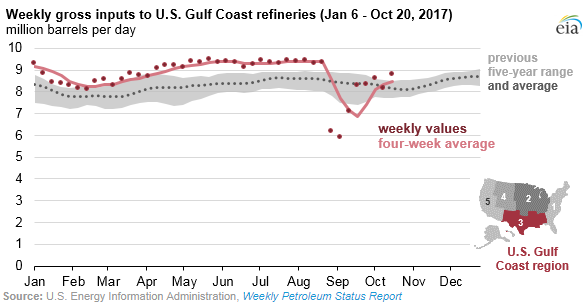

Gulf Coast Refinery Runs Approaching Pre-Harvey Levels

It’s taken some time, but refinery run rates are finally re-approaching their Pre-Harvey levels, refining roughly 9 million barrels per day for U.S. needs and exports. It’s not uncommon to take 8 weeks or more for oil infrastructure to recover after a major hurricane – Gustav/Ike and Katrina both took weeks before refining levels fully normalized. Click Here to read more from the EIA.

OPEC must think about exit strategy: Kemp

OPEC has a stated goal of returning global inventories to their 5-year averages, and they’re about halfway there. Saudi and Russian officials have expressed their commitment to extending the deal beyond March 2018 if needed. If they extend for too long, they risk prices shooting up, augmenting alternative energy technologies (this occurred in 1999/2000 and 2010/11 when OPEC tried to rebalance markets). If they don’t extend long enough, they’ll be right back where they started. Reuters analyst John Kemp suggests odds are good that they’ll overshoot their target as they’ve done in the past, causing prices to spike. Click Here to read more from Reuters

Saudi Aramco IPO Scaremongering Looks Overdone

Saudi Aramco, the largest energy company in the world, is continuing its pursuit of an IPO to raise $100 billion for 5% stake in the company, despite the hurdles. Disclosure requirements have been problematic, as is the Crown Prince’s insistence on valuing the company at $2 trillion. Still, as the largest oil company on earth, there are a lot of positive factors pushing the IPO forward. Platts writer Andy Critchlow says the IPO likely will occur on schedule or nearly on schedule. Click Here to read more from Platts.

Oil Majors See Strongest Growth in Years

Third quarter reports have been released by the oil majors, including Exxon, Chevron, BP, and Shell, and it looks like oil companies are growing strongly once more. Profits now are comparable to levels seen in 2014 when oil prices were over $100, showing that oil companies have become more lean and efficient. That bodes well for consumers – efficient producers have lower oil production breakeven levels, leading to lower prices overall. Part of the profits have also come from a pivot to focus on refining; refining segments profit on the spread between crude and refined products, which have been at two-year highs lately. Click Here to read more from MarketWatch.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.