How Wider Brent-WTI Price Spreads Affect U.S. Refining

For refineries on the East Coast, mainly concentrated in the Northeast, getting crude oil supplies can be harder than for other regions. There’s very little crude production in the Northeast, so crude must be shipped by pipeline or barge from other areas. Choosing between domestic and foreign oil is an on-going choice for refineries in the area, one that’s been heavily slanted towards foreign crude in recent years. With Brent-WTI spreads at two-year highs, the EIA analyzed whether East Coast producers have enough incentive to start using domestic crude oil. If you don’t want me to spoil it, you can read the article by clicking here.

Why the East Coast Prefers Foreign Crude

The slant towards using foreign crude may be surprising, given how much U.S. domestic production of crude oil has grown in recent years. But as production has grown, refineries have popped up locally to produce the product. This has certainly been the case in the Midwest, where refining capacity growth has outpaced national trends on a percentage basis since January 2010, thanks to strong production in Bakken fields creating local supply for refining.

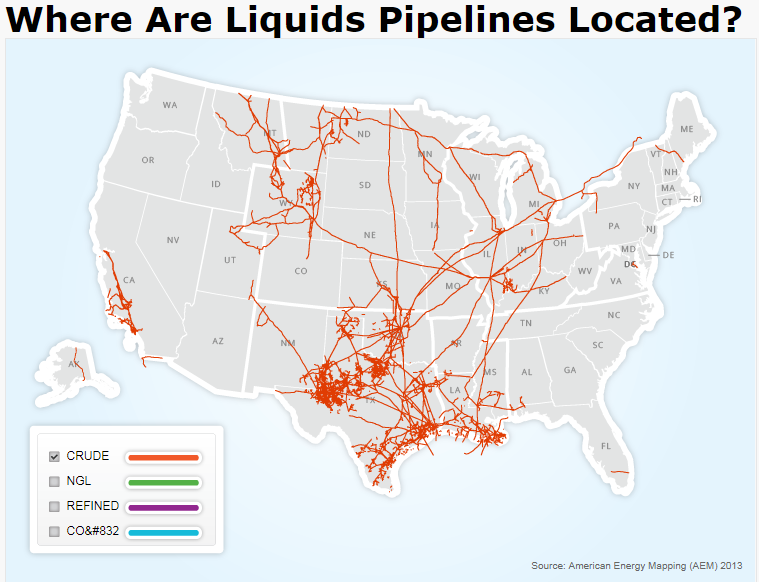

When not refined locally, most of that crude is getting shipped down to the Gulf Coast, where over 50% of the U.S.’s refining takes place. A decade ago, nearly all pipelines ran from the Gulf Coast refining hub up north to the East Coast, Great Lakes, and Midwest areas. Now, more and more pipelines are needed to bring crude oil from the north (Bakken and Niobrara oil fields) back down to the Gulf Coast. For a while, that necessitated rail road deliveries, but new pipelines have helped to reduce the need for rail deliveries of crude oil.

As that massive infrastructure change took place, both the West Coast and the East Coast were largely left out of the equation. The West Coast was left out because California is virtually an island for fuel production, producing nearly all of their gasoline and diesel locally due to strict regulatory standards. The East Coast does not have the strict regulatory standards that California has, but they were left out all the same. The main reason the East Coast prefers foreign oil is that they simply do not have the pipeline infrastructure to easily use domestic fuel.

Why Brent-WTI Spreads Matter Today

Because the East Coast has no pipelines to bring in domestic crude oil, it has three options: barge in oil from the Gulf, use rail deliveries of crude oil, or buy crude from other countries for import.

When WTI and Brent are at parity, it’s generally cheaper to buy foreign fuel. The Jones Act require that when shipping between U.S. ports, vessels must be American-made and fly a U.S. flag, which adds costs. Those Jones Act vessels, when transporting fuel, are typically used to bring refined fuel to Florida and Southeastern ports, much closer destinations. Due to prohibitive costs and constraints on vessels, shipping crude from the Gulf to the Northeast is uncommon.

Rail deliveries to the Northeast can occur, but rail tends to be less safe, and states in the Northeast tend to be wary of safety concerns related to fossil fuels. Rail also tends to be more expensive than pipeline deliveries, so Gulf Coast and Chicago refineries connected by pipeline to Bakken and Texas crude production have better economics when buying oil.

That leaves deliveries from Europe and other foreign sources of fuel. In general, as long as Brent and WTI prices are comparable, East Coast refineries will buy from foreign sources of oil. But with Brent-WTI spreads at two-year highs, is it time for those refineries to switch to Made-in-America crude oil?

I’ll go ahead and spoil the end now – according to the EIA, it’s still not enough. East Coast refineries were using domestic crude in 2014 and 2015 when Brent-WTI spreads were ~$15, but at just $6 today, it’s not worth the difference. It’s simply cheaper to buy from either Canadian or European sources.For that reason, PADD 1 use of domestic crude oil has plummeted.

East Coast Refining – Takeaways for Consumers

What does all that mean for Northeast consumers? Well, for one, you’re not necessarily getting the Made-in-America fuel you may have thought you were using. You’re more beholden to international price movements, rather than just WTI price changes. That’s important to understand when setting budgets and analyzing past results – the feedstock crude oil behind your fuel is probably driven by Brent prices, rather than WTI.

Another important result is that as U.S. production costs go down, the premium you pay in the Northeast will go up compared to the rest of the U.S. Don’t worry though, markets don’t like price spreads between areas. Arbitrage economics will soon kick in, and folks will find ways to send cheaper refined products from Chicago and the Gulf Coat into the Northeast.

In fact, we’ve already seen that trend underway. The Laurel Pipeline, which historically has taken refined products from Philadelphia and shipped them west towards Pittsburg, is undergoing a partial reversal. Products will travel from Chicago via the Buckeye Pipeline to Pittsburg, and with the reversal product will be able to flow all the way to Altoona. Many expect that products from Chicago will eventually be able to flow all the way to Philadelphia, which would cripple East Coast refineries by increasing supply options, a boon for consumers in the area.

Brent-WTI spreads have a role to play in all this. If spreads widen enough, companies may be incentivized to create crude infrastructure to supply the Northeast, reducing costs in the area. It’s unlikely spreads will reach $15 as in 2015, though – the lifted ban on oil exports ensures that widening spreads lead to more exports abroad, keeping the arbitrage opportunities narrow. For now, it looks like East Coast refineries will maintain business as usual, importing foreign crude oil. Consumers will have to wait for cheaper Midwest fuel to begin flowing to the Northeast, or increased shipments from the Colonial Pipeline from the Gulf, before they see more competitive pricing of fuel.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.