Today’s Market Trend

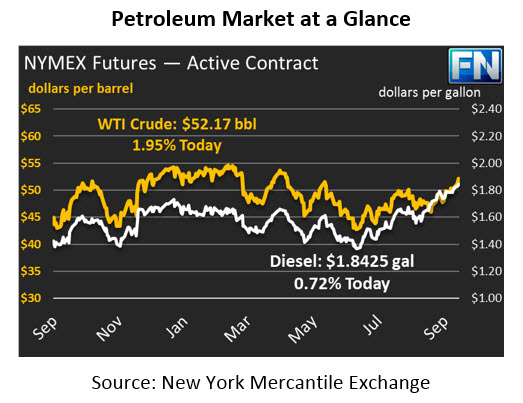

Oil prices across the board soared higher, with crude oil surpassing $52 to close yesterday, a full 3% gain during the trading session. Gasoline and diesel posted similar gains. Crude oil prices are currently $52.17, taking a breather overnight amid profit taking after yesterday’s strong price rally.

Refined products are in a similar boat. Diesel prices have continued blowing past multi-month levels, gaining 2.4% yesterday. After gaining 4.4 cents yesterday, today’s loss of 1.38 cents seems relatively small. Diesel continues to see strength amid strong fall demand, with prices at $1.8425 this morning.

Gasoline led the rally yesterday, gaining 5 cents (3.1%) in one day to break out of the mid-$1.60 range it’s been in. Prices have slowed their acceleration this morning, up just 35 points to $1.7255. Some of the rally may be attributable to Hurricane Maria. While the storm is not expected to hit the U.S., its time at sea has disrupted crude shipping channels, leading refiners in the Northeast to cut production. Coming after Harvey already caused severe supply tightness throughout the States, traders are taking the disruption seriously.

Overall, markets look responsive to OPEC’s remarks that cuts are working and that supplies are truly tightening. OPEC’s August compliance rates were reportedly 110%, signaling that producers are serious about their commitments to return supply to its 2013-14 tightness and raise prices. Of course, with prices up above the $50 level, U.S. producers look eager to hedge some production, bidding down 2018 and 2019 prices as they sell future oil commitments.

Another key news event yesterday was the Kurdistan referendum for independence from Iraq. While the results are still technically being counted, analysts are calling it a big victory for the Kurds, with a massive turnout in the affected regions and a majority supporting independence. Iraq is a major oil producer, so anything that changes the political landscape in Iraq is significant for global markets. Our second article takes a more in-depth look at the Kurdish referendum and what it means for oil markets.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.