Today’s Market Trend

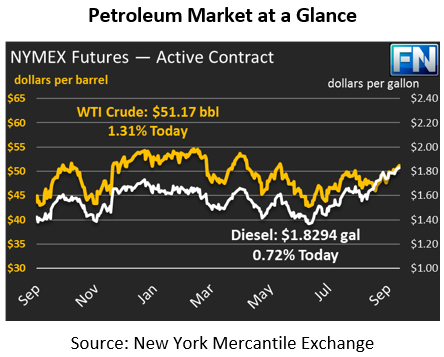

Oil prices are up across the board this morning. Crude oil gained about 50 cents this morning to reach $51.17. Prices haven’t passed above $51 since May, though in May crude could not maintain its position above $50 for a full week. Today marks eight straight days of prices at least touching above $50, and prices have closed over $50 for the past three trading sessions. With such strength seen in the past week, expect at least some traders to cash in their gains and exit the market, removing some of the upward pressure on prices.

Refined products are also up strongly today, supported by strong crude prices. Diesel prices are up 1.31 cents to $1.8294. Friday saw markets trade mostly flat, ending the day just 10 points above the opening price. Today, markets appear much stronger, driven by strong demand in the U.S.

Gasoline is also higher this morning, gaining 1.66 cents today to reach $1.6850. Gasoline outperformed other oil products on Friday, gaining 2.4 cents during the day while crude and diesel prices remained mostly flat.

OPEC drove the media on Friday, with their OPEC/Non-OPEC meeting closing up with no major announcements, in line with market expectations. Still, comments from participants after the meeting helped support oil prices. Kuwait’s oil minister indicated that global stocks are rapidly moving towards 5-yr averages. Iran’s oil minister also noted the progress made, though warned that Libya and Nigeria could offset any export cuts from OPEC.

Iraqi Kurds are voting in a referendum this morning to determine whether they should seek independence from Iraq. Unsurprisingly, Baghdad disapproves of the measure and is seeking to maintain control of the area and its oil fields. The referendum is non-binding, meaning nothing officially happens following the vote, but the regional Kurdish leader has said he would fight for independence if the referendum passes.

Neighboring countries, particularly Turkey, are worried that a successful vote could create similar sentiment among Kurds in surrounding countries. The U.S. and United Nations oppose the vote, saying it could lead to regional instability and distract from campaigns against ISIS. For oil markets, the move for independence could put several major oil fields under contention, creating uncertainty for markets that would likely cause prices to rise.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.