Today’s Market Trend

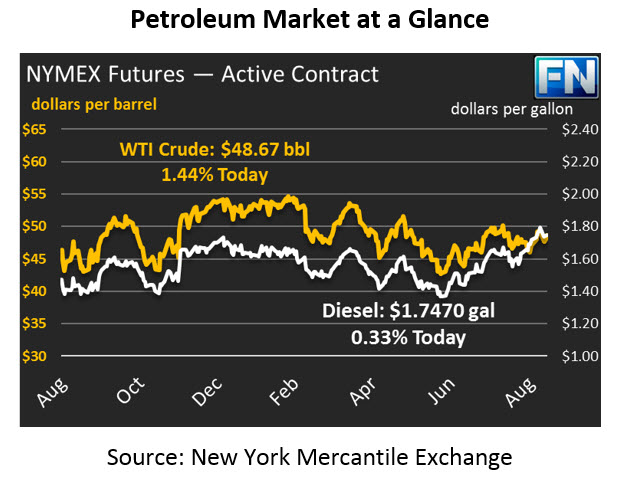

Prices are up across the board this morning, following EIA reports released yesterday showing stronger oil demand globally and reduced production. Crude prices responded by moving higher after losses in the early morning. Prices fell about 40 cents yesterday morning before rising to end the day with a net gain of 10 cents. Crude prices are $48.67, a gain of 44 cents (.9%) from yesterday’s close.

Refined products are also higher this morning. Diesel prices are up by over half a cent to $1.7470, a gain of .4%. Diesel prices traded flat throughout the day yesterday, and ended the day down just .22 cents from the opening price. Gasoline saw prices rise throughout the trading session, gaining over two cents to close at $1.6563. Prices this morning are up further to $1.6656, nearly a penny higher.

The API inventory report yesterday showed a crude inventory build of 6.2 million barrels (MMbbls), far lower than the market’s expectation of a 10+ MMbbl build. Gasoline draws did not fail to disappoint, falling 7.9 MMbbls as much refining capacity remains offline and swaths of cars hit the road to evacuate hurricane impact zones. Diesel stocks fell by just 1.8 MMbbls, as commercial operations in Texas and Florida remain largely offline. Once refining capacity returns to normal run rates, analysts expect inventory levels to see lower fuel consumption overall as individuals stay off the road to focus on repair work and commercial operations take time to restart.

Numerous reports have been released this week that paint a bullish picture of markets. First, OPEC’s Monthly Oil Market Report, released Tuesday morning, showed that OPEC production fell 80 thousand barrels per day (kbpd) in August as Saudi Arabia cut production and Libya experienced oil field disruptions.

Later, the International Energy Agency (IEA) released its August Oil Market Report which showed that global demand grew by 2.3 MMbpd (2.4% year-over-year) in the second quarter of 2017, and production fell 720 kbpd in August due to several supply outages. The organization also noted that OECD inventories, which typically build during this time of the year, remained flat, with a 190 MMbbl surplus.

The EIA also releases its Short-Term Energy Outlook, which showed U.S. production falling for the first time in several months, down 40 kbpd from July levels. The report also revised annual production down from 9.35 MMbpd to 9.25 MMbpd. Our second article today provides more details from the STEO.

Overall, as the market emerges from being captivated by hurricane impacts, the picture is looking more bullish for prices overall. OPEC is continuing to talk up another extension of their production cuts, and the global supply/demand picture is beginning to look more conducive to higher oil prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.