Today’s Market Trend

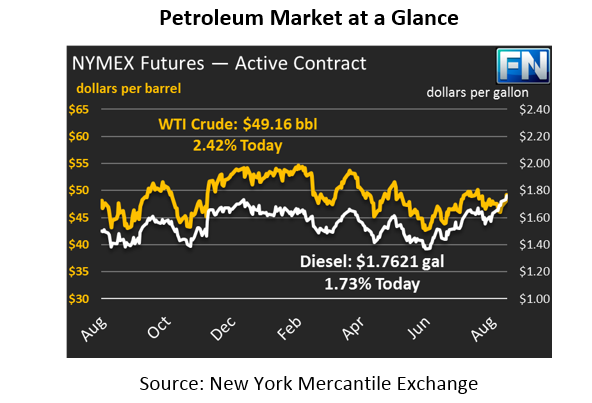

Crude prices are $49.16 this morning, their highest levels since the beginning of August. Crude prices grew quickly towards the end of the day, rising from $47.28 to $48.66, a 3% gain for the day. This morning prices are up $.50, or 1%. After prices fell rapidly during Harvey, it appears markets are looking for higher ground. While crude demand in the U.S. remains far below normal levels, markets are enthusiastic that demand will return.

Refined product prices have been mixed. Diesel continues to make gains this morning, rising to their highest levels since July 2015. Prices are currently $1.7621, a gain of 1.4 cents after choppy trading yesterday. Overall, the trend for diesel prices has been up, but yesterdays’ trade was all over the place, with prices rising two cents from the opening price but settling half a cent below the opening price.

Gasoline prices continue to take a beating, down 2.6 cents (-1.5%) this morning to reach 1.6734. Prices opened yesterday at $1.75 and lost 5 cents, and today the decline continues. Gasoline prices had reached $2 last week during Harvey, their highest level in years, but they’ve since calmed down and are giving up their gains. It’s worth noting that, according to Goldman Sachs research, fuel prices typically spike during and immediately after a hurricane, but tend to fall lower in the weeks following as demand remains offline due to the destruction.

Crude prices have been boosted by increased refiner demand, as more Gulf Coast refineries come online. Goldman Sachs estimates only 2 MMbpd of production remain offline, compared to nearly 5 MMbpd at the height of the damage. Yesterday, Motiva’s Port Arthur refinery, the largest refinery in the country, announced they were restarting some units and expect capacity to be around 40% by the weekend. Given the two-week estimates they had previously announced, the news is a huge boon to consumers in Texas and the Southeast.

Russia’s Energy Minister commented today that the country is open to extending the OPEC/Non-OPEC production cuts further into 2018 if necessary to make more progress towards reducing global inventories. Currently, the deal is set to expire at the end of March 2018. Countering the bullish news, Libya’s oil fields will be coming back into production following a deal between Libyan officials and militants. For two weeks, approximately 1/3 of Libya’s oil production has been offline as its largest oil field, Sharara, was offline. Libya’s high production levels have been a concern for OPEC; as Libya brings its capacity back online, OPEC will have to become more serious about its production cuts to keep the organization’s total exports down.

Today’s second article looks at how Harvey has affected fuel prices nationwide, and which areas have been most effected by the damage. Later today, we’ll provide an update on the reconstruction efforts following Harvey and share more details related to Hurricane Irma.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.