Today’s Market Trend

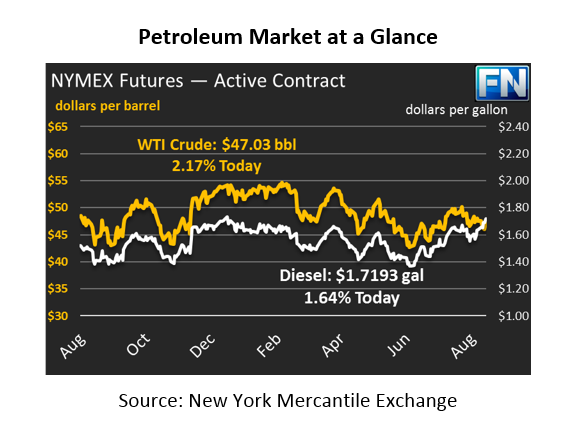

As noted yesterday, having prices role from September contracts to October contracts has had a huge effect on prices this morning. Recall that NYMEX prices are future prices, so the price you see today is for “prompt month” (currently October) delivery. Crude prices are up a dollar to $47.03 this morning, though down overall for the October contract compared to its close yesterday.

Gasoline prices are down significantly this morning, at $1.7257. Gasoline prices closed yesterday at $2.14 for the September contract. The October contract has actually fallen over 5 cents since yesterday, as markets become less anxious about refinery damage. While the disaster recovery will take time, no major damage has been announced from refineries in the Gulf that would delay restarts for months.

Diesel prices did not experience much storm anxiety, gaining just 10 cents over the week, compared to the 50 cent gains in gasoline prices. For that reason, there was no major drop in diesel prices as the September contract expired; however, diesel prices have fallen over two cents this morning.

News unrelated to Harvey’s recovery efforts is light. Expect demand to rise in the affected areas as reconstruction begins over the coming month. Folks in the Gulf are carefully monitoring Hurricane Irma’s development, which is already a Category 3 Hurricane heading towards the Lesser Antilles. Forecasters disagree about the direction of the storm, with estimates ranging from New Orleans landfall up to the Northeast coast. The storm’s direction won’t be known for certain until after Labor Day.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.