Today’s Market Trend

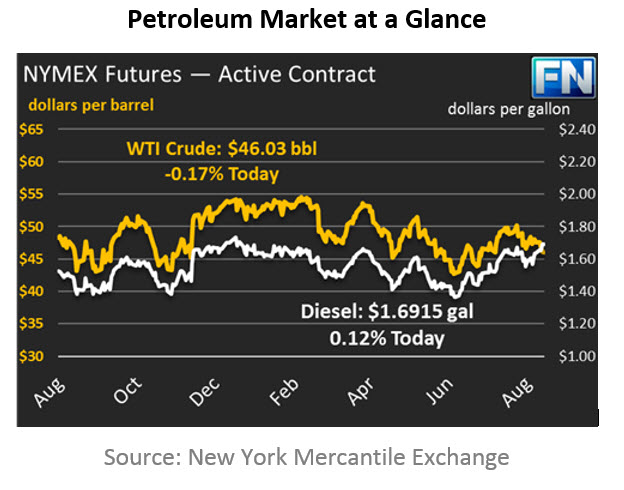

Crude prices remain lower today as refineries in the Gulf remain offline, reducing crude demand. Prices are 46.03 this morning, above their close yesterday of $45.96. Prices have been struggling; crude barrels were trading at a low of $45.58 this morning, the lowest its traded since July. 4.6 MMbpd of refinery production remain offline, keeping crude in storage and prices low.

Refined products continue their high trek. Gasoline prices have surpassed $2.00 this morning, and are currently $2.007. Keep in mind, however, that NYMEX prices are for prompt month delivery – that is, the price quoted today is for September gasoline. Tomorrow, on Sept 1, that roles over to the October contract, which has been trading around $1.68, closer to where prices were before Harvey hit. With that in mind, expect to see a large drop in gasoline prices in tomorrow’s FUELSNews.

Diesel continues its steady rise, closing yesterday at $1.6738 and reaching $1.6915 this morning. Diesel prices have been far less volatile than gasoline prices throughout the week, since extreme weather conditions typically shut down businesses, taking diesel trucks off the road, while increasing gasoline as individuals drive away from the damage. NYMEX October prices have been trading at $1.67, not far below current NYMEX prompt month prices.

The EIA largely confirmed the API inventory data, but analysts widely agree that inventory reports will be extremely difficult to interpret over the coming weeks. With market attention focused on the Gulf Coast, changes in inventory levels had little effect on the market, despite appearing to be bullish overall for crude.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.