Today’s Market Trend

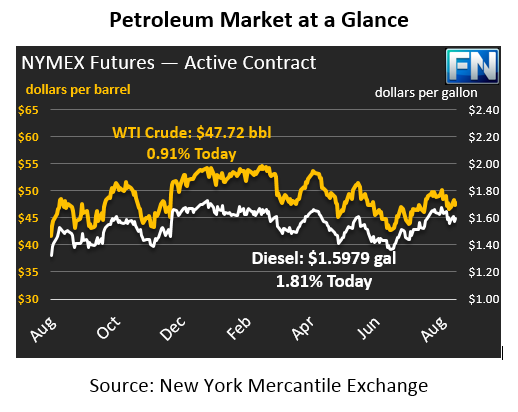

Crude prices remain mostly unchanged from yesterday’s close losing a mere 11 points (.23%) to be trading at $47.72 this morning. During yesterday’s trading, crude remained fairly flat with only 83 cents between the high and low of the session.

Refined products have made slight gains since yesterday’s close. Like crude, gasoline remained mostly flat during yesterday’s trading session, opening at $1.5905 and closing only 3 point higher at $1.5908. Gasoline prices continue to linger this morning at $1.5918, only 10 points (.06%) higher than their close yesterday. Diesel saw a little more movement during yesterday’s trading opening at $1.5728 and gaining almost 2 cents to close at $1.5912. Prices have continued to gradually increase this morning gaining 67 points (.42%) since closing and are currently $1.5979.

The API reported that crude inventories fell by 3.6mmbbls, only slightly more than the market was expecting (3.5mmbbls). The API also reported a 1.4 MMbbl gasoline stock build, compared to an expected 0.093 MMbbl stock build. This week’s higher than expected gasoline build is its 3rd build in three consecutive weeks during a time when inventories typically experience draws. Some analysts attribute these unexpected builds to record refinery runs that could be distorting historical seasonality of product draws. Diesel inventories also built this week by 2.05 MMbbls. The EIA report will come out this morning to reveal the exact inventory numbers from last week.

Tropical storm Harvey continues to threaten Coastal Texas and southern Louisiana as it makes its way through the Gulf of Mexico. The remnants of the storm are expected to redevelop into a tropical storm, and if the storm continues to slow, become a Category 1 hurricane. Harvey will likely make landfall Friday afternoon, bringing heavy rains and strong winds stretching from Brownsville, TX to Lake Charles, LA. Flooding and power outages are expected, which could lead to refinery disruptions in Coastal Texas over the next five days.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.