Natural Gas News – August 14, 2017

Nat Gas News – August 14 2017

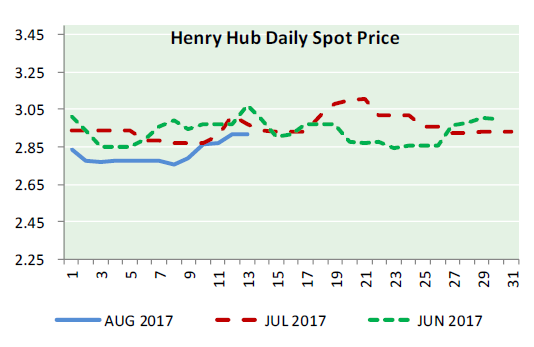

‘Cowboy’ Trader Bill Perkins: Look for This Commodity to Jump More Than 30 Percent

CNBC reports: Bill Perkins of energy hedge fund Skylar Capital says the natural gas market could soon rev up. With American exports of natural gas on the rise, while infrastructure “isn’t coming on fast enough,” Perkins makes the point that “we actually have a very tight market now.” “Right now we have the demand-side infrastructure — that being exports — coming on first, and the supply-side infrastructure has not yet caught up,” Perkins said Thursday on CNBC’s “Futures Now.” “I do believe eventually supply will catch up and kind of normalize prices, but for the next 12 to 18 months, I think the market is in an increasingly bullish position.” The commodity has recently jumped from $2.75 per million Btu to about $3 per million Btu. During the winter, Perkins expects natural gas prices to rise to $4. Yet Perkins grants that weather, that famous driver of natural gas, could throw a wrench in that thesis. For more visit cnbc.com or click the following link http://cnb.cx/2vvplsL

Almanac: Plenty of Cold, Snow for This Winter for Northeast

Bloomberg reports: Northeasterners, keep your mittens, boots and show shovel handy. The Farmer’s Almanac that goes on sale this week predicts a snowy winter from Maryland to Maine with five coastal storms to bring winter misery to the region. The publication, now in its 200th year, isn’t afraid to go out on a limb with long-term weather forecasts that rely on a formula founder David Young first used in 1818 that utilizes sunspots, tidal action and other factors shunned by modern scientists. For more on this story visit bloomberg.com or click https://bloom.bg/2uTc75i

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.