Weekly Price Review

Prices appear to be set up to close the week in the red, rising throughout the week before falling significantly lower yesterday afternoon. Crude prices opened the week at $49.59, and briefly surpassed the psychological $50/bbl level yesterday morning before falling steeply. Crude opened this morning at $48.52, a loss of over $1 (2.2%) from the beginning of the week. The market reached its highest point yesterday at $50.22; the lowest point of the week was earlier this morning at $48.01, a range of $2.21.

Refined products had a similar week, though gasoline and diesel saw a bit more volatility in between peaks. Refined product crack spreads (the difference between refined product prices and WTI crude prices per gallon) fell slightly this week, though they remain at relatively high levels. Refined products have been boosted by a major refinery outage in Europe, as well as extremely high U.S. demand for gasoline and diesel.

Gasoline opened the week at $1.6525; today they opened at $1.5968, a loss of 5.6 cents (3.4%) over the course of the week. The significant loss was attributable to the significant stock build demonstrated in the EIA inventory report this week.

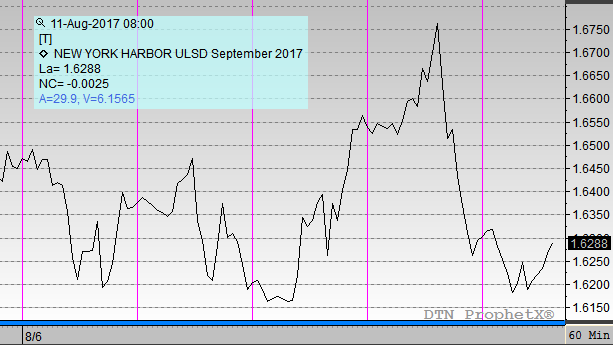

Diesel prices performed with relative strength, giving up only 1.31 cents (.79%) to open this morning at $1.6308. For the first time in months, diesel prices rose higher than gasoline prices late last week and have remained stronger, likely attributable to falling gasoline prices as summer demand seasons winds down.

This week’s inventory report helped push prices higher for a while, helping crude push above $50/bbl temporarily before falling lower. The EIA reports a crude stock draw of -6.4 MMbbls, along with a diesel stock draw of 1.7 MMbbls. Gasoline inventories, on the other hand, grew by 3.4 MMbbls, above market expectations. The API inventory, which has struggled recently with accuracy compared to the EIA data, was directionally correct this week, predicting the build in gasoline stocks despite market expectations of a draw.

Markets have been fixated this week on evolving news about the threat of action from North Korea. North Korea recently reported that they had the capabilities now to deliver a nuclear missile into the U.S., which President Trump responded to by threatening “fire and fury” on Twitter. Stock markets have experienced significant losses due to shaken market confidence, and these losses have spilled over into oil markets.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.