Today’s Market Trend

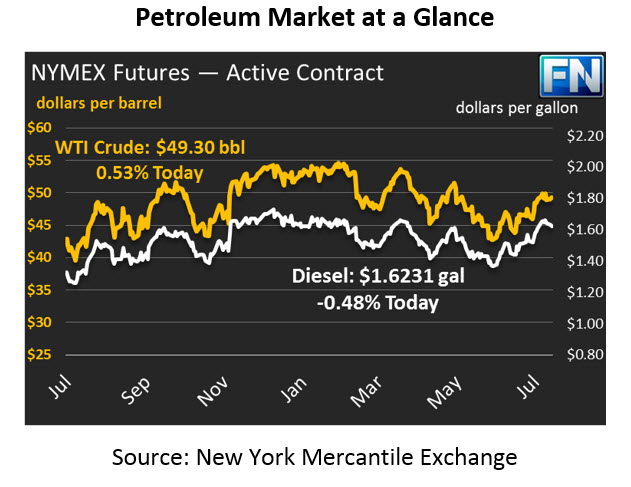

Crude prices are $49.30 this morning, down 9 cents (.18%) from yesterday’s close of $49.39. The market experienced a price drop of around a dollar between yesterday’s opening price and the day’s low. Crude recovered 85 cents of its $1.05 loss.

Refined products opened slightly below yesterday’s closing price. Diesel prices lost slightly over a penny (1.02%) and are currently $1.6231. Gasoline prices are $1.6059, down over 2 cents (1.47%). During yesterday’s trading session, diesel and gasoline followed crude prices down as they saw lows of $1.6154 and 1.6042, down 3.36 cents and 4.83 cents from their opening prices. Both markets were able to rebound from the lows; however they did not make a full recovery closing at $1.6398 and $$1.6299 respectively.

Saudi Aramco (Saudi Arabia’s national oil company) has announced that it will be cutting allocation to its global clients in September by 520,000 bpd in effort to reduce global supply and strengthen oil prices. Markets expect approximately 10% cuts from exports to Asian countries. Of course, the “cuts” must be taken in context – Saudi Arabia’s production rose to YTD highs in July, and no clarification has been made on whether cuts will come from July’s production level or from their promised production cuts. It’s also important to note that Saudi Arabia’s exports typically drop in September.

All eyes are on OPEC once again as they wrap up their two-day meeting in Abu Dhabi. No news was leaked from the meeting yesterday, likely signaling that progress has been slow. The organization has been talking about improving group compliance with their cuts, as well as how to address Libyan and Nigerian crude. Nigeria’s production has now surpassed two million barrels per day, and continues to strengthen.

The Pernis refinery in Europe, which has been offline since July 30, is undergoing restart procedures today, according to a statement from Shell. A fire last week took most parts of the refinery, taking 404 kbpd of refined products off the global market. That represents over 2% of the U.S.’s entire daily refined product consumption. The outage has given significant strength to refined products over the past week; as the refinery comes back online, both gasoline and diesel prices should weaken somewhat relative to crude prices.

The API weekly inventory report will be coming out this afternoon. The market is expecting its sixth straight week of inventory depletion, which is in line with this week’s historical aggregated inventory falls of 3.8 million on average over the past five years.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.