Today’s Market Trend

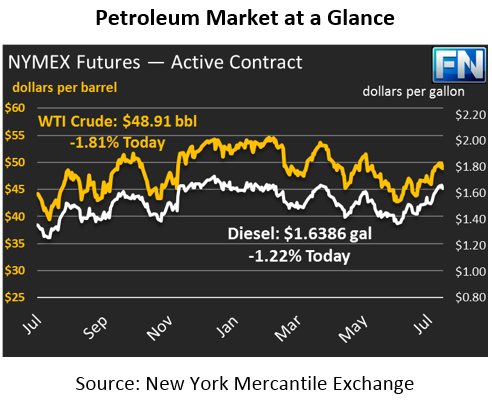

Crude prices are somewhat lower this morning, falling to $48.91 since closing yesterday. Prices yesterday fell 56 cents (1.1%) to end the trading session at $49.03. This morning, prices opened at $48.95, almost a dollar lower than where they opened on Monday.

Refined products are showing mixed results. Diesel prices are down slightly, though they’ve seen a significant loss since yesterday. Prices opened yesterday morning at $1.6572; they’re trading at $1.6386, a loss of nearly 2 cents. Gasoline prices are also lower than yesterday’s opening price, though only by .52 cents. Gasoline prices are up slightly this morning, gaining .85 cents (.5%) since closing yesterday; diesel prices are nearly flat, down just 3 points from yesterday’s close.

Markets are awaiting news from OPEC’s meeting taking place next Monday and Tuesday. OPEC will be discussing member compliance rates, as well as what to do about Nigeria and Libya. It’s unlikely that prices will fall during the meeting – non-compliant members have little incentive to advertise their non-compliance, so don’t expect an announcement of countries openly ignoring the cuts. If anything, there is a risk of higher prices if Iraq, who currently is only 30% compliant with their cuts, commits to reduce its production, or if progress is made with Libya and Nigeria.

Markets will also be watching today’s employment report to get a feel for the state of the economy. Economic strength has been growing lately, and this strength has helped push gasoline demand to record highs. Markets are anxious to confirm that the high demand will continue, in order to justify more bullish trading.

Reuters published recently that U.S. shale producers will help keep a lid on prices as the year continues, with production rising 160 kbpd above market expectations, if Q2 regulatory filings are to be trusted. Despite a reduction in long-term capex projects, producers are looking to boost short-term output, which will help offset OPEC’s continued attempts at supply reductions.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.