Natural Gas News – August 1, 2017

Natural Gas News – August 1, 2017

How U.S. Natural Gas Will Help Countries Meet Their Paris Commitments

The Fayette Tribune reports: According to the Energy Information Administration (EIA), energy-related U.S. carbon emissions have declined from about 6,000 million metric tons in 2005 (the agreement’s baseline date) to 5,170 MMT in 2016 — a 14 percent reduction in a decade. Ironically, the U.S. natural gas production boom could help other countries meet their commitments as well. U.S. natural gas pipeline exports to Mexico have quadrupled recently because the country realized it’s cheaper and cleaner than other fossil fuels for electricity generation. Natural gas releases about half the carbon emissions of coal. The primary reason U.S. carbon emissions have been declining over the past decade is power generating plants have been shifting from coal to inexpensive natural gas.

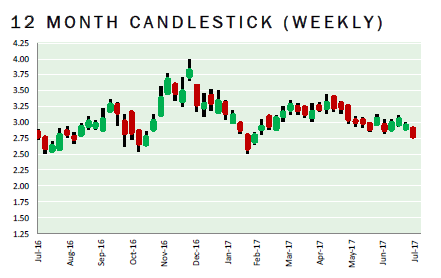

Natural Gas Prices Slide To 20-Week Lows On Fundamental Doubts

Economic Calendar reports: The latest NYMEX data recorded a decline in the gross non-commercial long positions in the latest week to the lowest level for 3 months and there was also a modest decline in the net long position, lessening the risk of short -term position liquidation. The latest weather forecasts continue to suggest that overall weather conditions will be cooler during the first week of August which will tend to sap natural gas demand. Although there will still be very hot conditions over Western areas, cooler temperatures are likely to prevail in Eastern and central area which will have an important impact in undermining gas demand.

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.