Natural Gas News – July 26, 2017

Natural Gas News – July 26, 2017

Appalachian States Look Past Coal, Ask Trump to Aid Natural Gas

Bloomberg reports: Having lost tens of thousands of coal mining jobs to the rise in natural gas, several states have decided if you can’t beat them, join them. A bipartisan group of lawmakers hopes to persuade President Donald Trump to spare a loan pro-gram he wants to kill and use it to help a $10 billion gas-storage project in the hard-hit Appalachian region of the eastern U.S. where coal had once dominated. Proponents say it would help spur new chemical, refining and other manufacturing industries — and give out-of-work miners a new career path. Coal and natural gas compete in the electricity markets and the proliferation of fracking in recent years led to cheaper gas that has displaced coal. Coal had once accounted for more than half of all U.S. electricity generation, but last year natural gas topped coal to become the largest source of power generation. The impact has been felt especially hard in the Appalachian region — which was once largely dependent on coal mining and steel production. For more on this story visit bloomberg.com or click https://bloom.bg/2uUyICM

U.S. Natural Gas Futures Start the Week on Back Foot

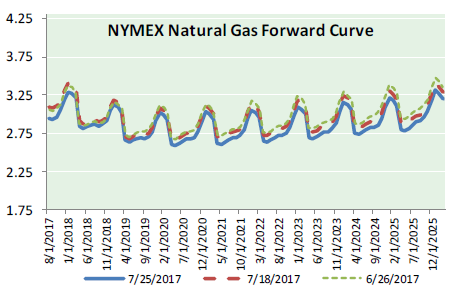

Investing. com reports: U.S. natural gas futures were higher on Tuesday, rising for the first time in five sessions as investors returned to the market to seek cheap valuations. U.S. natural gas for September delivery was at $2.925 per million British thermal units, up 4.3 cents, or around 1.5%. It fell to its lowest since July 10 at $2.866 in the prior session. Prices ended lower for the fourth day in a row on Monday amid bearish weather forecasts that should limit demand. Early market expectations for this week’s storage data due on Thursday is for a build in a range between 22 and 32 billion cubic feet in the week ended July 21. For more visit investing.com or click http://bit.ly/2tH3XBu

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.