Weekend Summary

Have an article worth sharing? Send it to FUELSNews@mansfieldoil.com, and we’ll share it next week in our Weekly Summary segment.

Venezuela instability threatens oil prices

“We may be about to see the first sovereign producer to unequivocally fail.” This quote from Helima Crodt, head of commodity strategy at RBC Capital Markets, summarizes the situation in Venezuela. With the government attempting to consolidate power, a collapsing economy, and the threat of U.S. sanctions, Venezuela may be on the verge of complete breakdown, taking up to 2 MMbpd off the market. Click Here to read more from Bloomberg.

Saudi Arabia pledges deeper cuts in August

At this weekend’s OPEC meeting, Saudi Arabia pledged to cut their exports to just 6.6 MMbpd, one million barrels lower than last year. Analysts say these cuts show the Saudi Arabia is walking the walk, not just talking the talk, on rebalancing the market. Click Here to read more from Reuters.

OPEC/NOPEC meeting expectations

With crude product surging globally, OPEC has had much to discuss this weekend. Saudi Arabia and Russia have seemed satisfied with current cuts, while some want to add Nigeria and Libya to the cut agreement to cap their output. Click Here to read more from Platts.

Yara: Urea prices to remain low amid U.S. oversupply

Urea prices (the main ingredient in diesel exhaust fluid) are expect to remain high as supplies internationally, and particularly in the U.S., are rising. While Chinese output has fallen, other countries have filled the gap to create a supply glut of urea on the market. Click Here to read more from AgriMoney.com

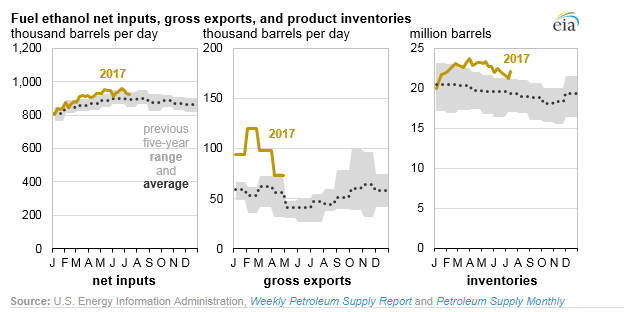

Ethanol production continues to rise

So far this year, ethanol production in the US has averaged 1.02 MMbpd, 5% higher than the first half of 2016, according to the EIA. Growing gasoline demand has created more need for ethanol to blend, creating a strong market for ethanol. All of this comes despite a shaky political environment for biofuel producers. Recently, legislation was introduced extending the $1/gal bio tax credit; if the credit is extended, production will certainly rise even higher. Click Here to read more from the EIA.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.