Nat Gas News – July 19, 2017

Nat Gas News – July 19, 2017

$3 Billion Natural Gas Pipeline Plan Halted due to Loss of Funding, Permits

Spare Change News reports: Major energy companies Eversource and National Grid, alongside pipeline operator Enbridge, announced on June 29 that they notified the Federal Energy Regulatory Commission (FERC) that the three companies would suspend the permitting process for their natural gas pipeline project. The approximately $3.2 billion project, known as Access Northeast, allegedly needs more time to create a stronger political support for a proposed tariff on electric ratepayers, according to oil news-analysis company, OilandGas360. The original curated legislation would “allow the costs to be shouldered by electricity customers,” and was met with a large amount of backlash. The companies argue the pipeline expansion plan is needed to bring overall cheaper natural gas to the Northeast’s power plants, and would significantly make colder days for the powerplants easier, noting that the demand rises during the Winter months. For more on this story visit sparechangenews.net or click the following link http://bit.ly/2uFxBHm

Oil and gas officials are confident in the industry’s bright future

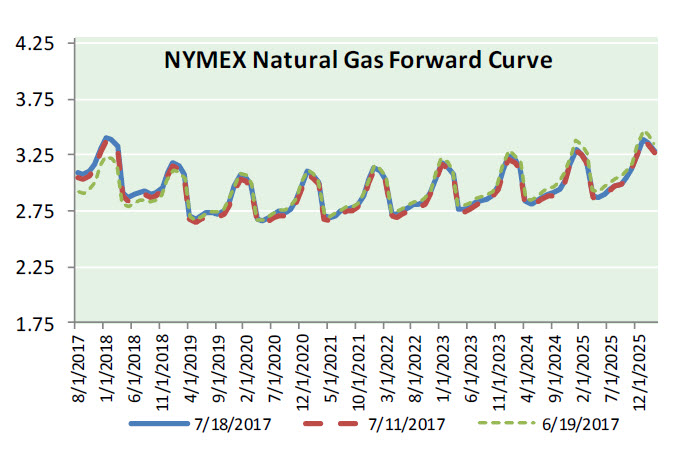

Nasdaq reports: U.S. natural gas futures rallied to the highest level in more than two-weeks on Tuesday, as updated weather forecasting models continued to point to increased summer demand in the coming weeks. U.S. natural gas for August delivery was at $3.091 per million British thermal units by 9:15AM ET (1315GMT), up 7.1 cents, or around 2.4%, after touching $3.094 earlier in the session, a level not seen since June 30. Hot high pressure over the western, central, and southern U.S. will strengthen and expand as the week progresses for strong national demand. For more on this story visit nasdaq.com or click the following link http://bit.ly/2tCQLZC

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.