Executive Brief: Tomorrow’s Vehicles—Projections Through 2025

Editor’s Note: The Fuels Institute recently published an in-depth analysis on the future of vehicles sales in the U.S., along with how those trends will affect energy markets. Click one of the below links to download the full analysis. Below, we’ve shared the Executive Brief

Regulations affecting light, medium and heavy duty vehicles in the United States and Canada have the potential to dramatically reshape the transportation industry in the next 10 to 20 years. The vehicles are coming on line and the fuels they will require could in turn influence the landscape of the fuel supply and distribution industry. This combination could alter the mobility market more dramatically than any development since the invention of the internal combustion engine in the late 19th century.

But what will be the ultimate impact? The Fuels Institute seeks to set prognostications aside and look specifically at market conditions and trends. To provide such perspective, the Fuels Institute commissioned Navigant Research to develop a forecast of vehicle sales and registrations, segregated by primary fuel-type and powertrain, through 2025. The Institute is releasing this study in three segments: 1) Tomorrow’s Vehicles – A projection of transportation fuel demand through 2025; 2) Tomorrow’s Vehicles – A projection of the light duty vehicle fleet through 2025; and 3) Tomorrow’s Vehicles – A projection of the medium and heavy duty vehicle fleet through 2025.

Tomorrow’s Vehicles – A projection of transportation fuel demand through 2025

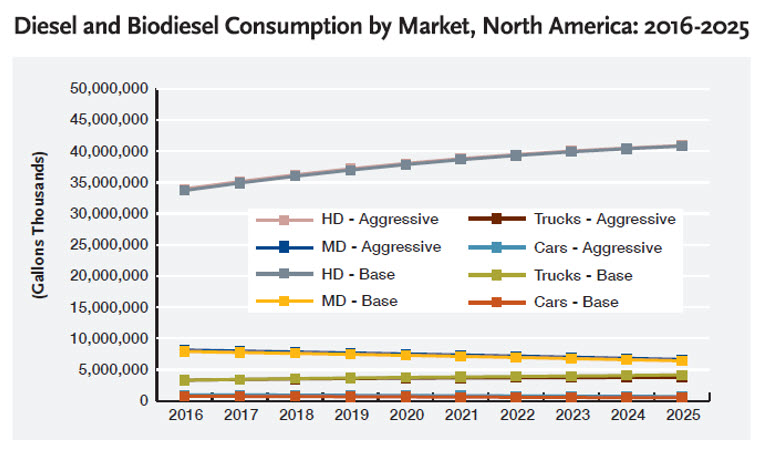

The powertrain forecast through 2025 does not indicate that the market will dramatically change through 2025. In 2016, gasoline and diesel fuel dominated the landscape for transportation fuels, and through the forecast period, Navigant Research projects only modest change. Even in the Aggressive*

scenario, gasoline and ethanol see minimal reduction in consumption and diesel and biodiesel see a slight increase. This roll-up summary indicates that the traditional fuels markets are unlikely to experience much deterioration in market share over the next decade.

Tomorrow’s Vehicles – A projection of the light duty vehicle fleet through 2025

The consumption of fuel types is largely dictated by the fuel economy requirements and the powertrains brought to market by the automakers. The following charts present the Aggressive scenario forecast for light duty vehicle sales and registered vehicles. The sales graphics demonstrate that in this scenario, the number of vehicles sold in 2025 that operate on non-petroleum powertrains will increase market share. In fact, battery electric and plug in hybrid vehicles in this scenario are projected to secure approximately 8% of new vehicles sold. However, flexible fuel vehicles are projected to decline to less than 1% due to the expiration of the credit afforded to automakers. Overall, gasoline and diesel-powered vehicles are projected to lose modest market share in the Aggressive scenario, dropping from a combined share of 89.2% in 2016 to 88.4%.

However, because the U.S. light duty vehicle population totals nearly 250 million units, changes in sales market share take many years to be reflected in the composition of the vehicle fleet that is on the road. Even in the Aggressive scenario, there are projected to be minimal changes in the light duty fleet.

Tomorrow’s Vehicles – A projection of the medium and heavy duty vehicle fleet through 2025

The medium and heavy duty market, which can be classified as the commercial vehicle market, is also subject to new fuel economy requirements that are forcing a change in market strategies. The actual numbers mandated under the program do not seem overly onerous on the surface, but represent a 23% improvement in efficiency. From the Navigant Research projections, it is evident that even in the Aggressive scenario most of these advancements will take place within the market of the internal combustion engine operating on gasoline and diesel fuel.

In the sales projection, alternative powertrains (including gasoline and diesel hybrids) are projected to potentially represent a combined market of less than 8% in the U.S. This translates into even smaller movement in registered vehicles, where alternative vehicles on the road will represent less than 4% of the market. Meanwhile, gasoline and diesel will maintain their dominant share of the fleet with 92% of medium and heavy duty vehicle sales and 96.2% of vehicles on the road.

Market Transition

Through 2025, it appears that innovation in powertrain technology will progress more rapidly in the light duty market than in the heavier segments, although even that transition will be relatively slow. All vehicle segments remain firmly entrenched in traditional liquid fuel powertrains through 2025, but beyond that alternatives may be able to capitalize on growing momentum. Achieving that modest 8% market share of light duty sales could position electric powertrains to gain momentum that could lead to a significant change in the fleet by the early 2030s. In the commercial sector, a shift could likewise be possible beyond the forecast period.

Tomorrow’s Vehicles Through 2025 demonstrates that the vehicles market is unlikely to undergo revolutionary change by 2025, but the seeds may be forming to enable rapid expansion of alternatives in the years beyond the forecast. It is critical to pay attention to trends in vehicle availability and sales to provide some insight into what may be on the ground years later. The size of the market precludes rapid fleet conversion, but compounded growth rates in alternative vehicle sales can result in a significant market transition.

However, despite reports and prognostications to the contrary, due to fleet size and modest growth in the sale of alternative vehicles in the next 10 years, the vehicle and fuels market is highly unlikely to undergo any significant change through the late 2020s.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.