Weekly Price Review

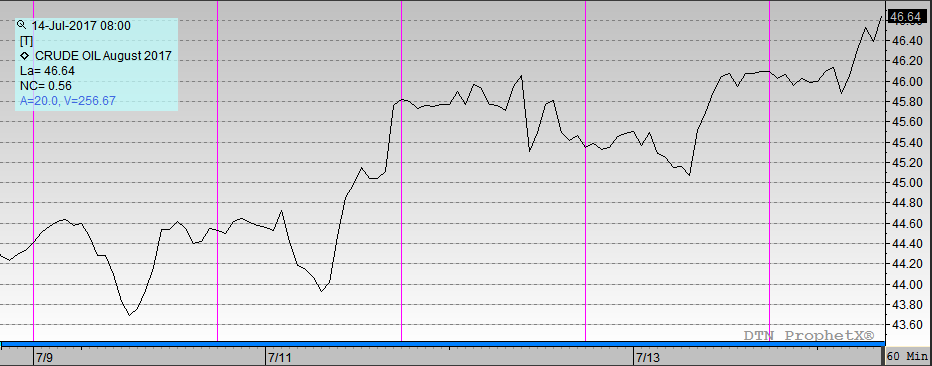

After a slow start comprised of daily up-down-up movement, prices this week have risen higher amid a falling dollar and inventory stock draws. Prices have risen from an opening price of $44.35 on Monday to over $46 today, a gain of around $2/bbl, or around 4.5%.

Prices have been range-bound in recent weeks, hovering in the $43-$47 range since late June. Prices on Wednesday of last week reached a high of $47.32, which was the highest price since the first week of June. In the absence of major fundamental news to nudge the market one way or another, it appears the market is comfortable with this range.

Diesel prices have mostly ranged from lows of $1.43 on Monday to highs of $1.5116 this morning, representing a 5.7% gain during the week. Diesel prices fell faster than crude and gasoline prices yesterday due to the reported diesel stock build, but have since been pulled higher by rising crude prices.

Gasoline prices rose 4.96% this week, and today are just off their highs of $1.546. Gasoline received a boost from inventory draws reported yesterday, but were held back by reports that gasoline demand had fallen since last week.

The highlight of the week was the EIA’s inventory report, which showed the biggest crude stock draw of the year, a hefty 7.6 MMbbls. However, coupled with this news came an IEA (International Energy Agency) report that OPEC production, as well as non-OPEC supply, was rising, and OPEC compliance had fallen to 78%. Still, the report revised its demand forecast upward, which will push prices higher.

The dollar has fallen over the course of the week, losing roughly .77% of its value. A falling dollar causes prices to rise, though given the relatively small decrease, the effect for oil prices was more the removal of headwinds.

For several weeks now, we’ve reported that prices rose during the week, or that prices fell during the week – the market volatility that had vanished in Q1 appears to be coming back into the market, albeit slowly. While prices have been mostly range-bound this month, prices have begun showing a bit more variability, rising to $50 before crashing again to the low-$40s. What will it take to break out of this pattern? We’ll just have to wait and see.

This article is part of Crude

Tagged: oil prices, Weekly Prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.