Weekly Price Review

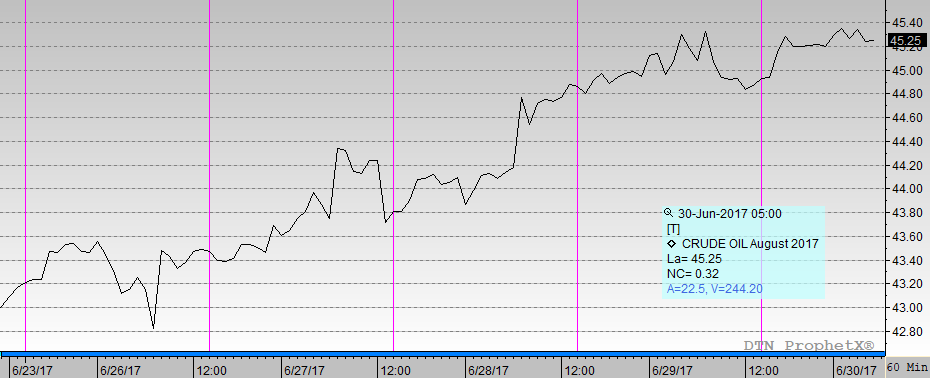

Oil prices rallied this week, breaking a month-long downturn. WTI crude prices regained the $45/b mark today, in stark contrast to last week’s slump, which brought prices as low as $42.05/b on Wednesday. This had been the lowest price since August 2016. WTI opened at $44.89/b today, unchanged from yesterday’s opening price. Prices have been steady overnight. Prices are $45.21/b currently, up by $0.28 from yesterday’s closing price. This week appears to be well on its way toward being the first week in the black since the week ended May 19. As of the time of this writing, WTI is up by $2.11/b for the week, diesel is up by 7.45 cents/gallon, and gasoline is up by 5.39 cents/gallon.

WTI crude prices opened the week at $43.16/b. WTI opened this session at $44.89/b, an increase of $1.73, or 4.0%, from Monday’s opening. During the week, prices ranged from a low of $42.63/b on Monday to a high of $45.45/b on Thursday, a range of $2.82. WTI is $45.24/b currently, up by $0.31 from yesterday’s closing price.

Diesel prices opened Monday at $1.3765/gallon. Diesel opened this morning at $1.4467/gallon, a major recovery of 7.02 cents, or 5.1% for the week. Prices ranged from a low of $1.3578/gallon on Monday to a high of $1.4629/gallon on Thursday, a large price range of 10.51 cents. Current prices are $1.451/gallon, up by 0.50 cents from yesterday’s closing price.

Gasoline prices opened Monday at $1.4352/gallon. Gasoline opened today at $1.488/gallon, a decline of 1.54 cents, or 1.1%, for the week. Prices ranged from a low of $1.4121/gallon on Monday to a high of $1.5033/gallon on Thursday, a wide range of 9.12 cents. Prices are $1.4891/gallon currently, up by 0.35 cents from yesterday’s close.

This week’s price rally broke a five-week downturn in oil prices, the most sustained downturn this year. Between the week beginning May 22 and the week ended June 23, WTI crude prices dropped by $7.80/b. This week’s rally has recouped around $2/b of the loss. The second quarter of 2017 has seen a $5.80/b drop in WTI prices, with prices opening at $50.69/b on April 3rd and opening at $44.89/b today.

Although prices are seeking a higher equilibrium point this week—and may have found it at approximately $45/b—global oversupply continues to be the key issue in the market. Libya’s crude production reportedly rose to 935 kbpd this past week, up from 885 kbpd the week prior. Libya has announced plans to raise output to 1,100 kbpd in August. Nigeria hopes to raise its crude production to 2,000 kbpd in August, up from an average of 1,512 kbpd in the first quarter of 2017. Libya and Nigeria are not part of the OPEC-NOPEC production cut agreement.

Upward price movement was reinforced Wednesday by the release of the Energy Information Administration’s (EIA’s) weekly supply data for the week ended June 23. The EIA reported a small crude stock build of 0.118 mmbbls, which was more than counterbalanced by drawdowns of 0.894 mmbbls of gasoline and 0.223 mmbbls of distillate. This fed a bullish sentiment, which overcame the API’s earlier bearish prediction of an across-the-board stock build.

The oil complex retained value despite weakness in apparent demand. Gasoline product supplied fell by 278 kbpd to average 9,538 kbpd for the week. Diesel demand fell by 129 kbpd to average 4,029 kbpd. Over the four weeks of June through the 23rd, however, gasoline demand increased by 221 kbpd on average, while diesel demand rose by an unusually strong 524 kbpd.

The EIA also reported the year’s most significant drop in domestic crude production, a drop of 100 kbpd, which brought U.S. output down to 9,250 kbpd. Most of the drop was caused by Tropical Storm Cindy shutting in production, but the growth in U.S. production already had slowed significantly in May and June. During the first quarter of 2017, U.S. crude production increased by 429 kbpd. During the second quarter to date, crude production has grown by only 15 kbpd. It is possible that production is peaking.

A weak U.S. Dollar is also lending some support to oil prices. The Dollar index opened lower four days out of five this week, falling notably against the Euro and the Pound. During the week, the U.S. Dollar Index declined by 1.7%.

This article is part of Crude

Tagged: Weekly Prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.