OECD Oil Stocks Remain High Despite OPEC-NOPEC Cuts

The past month has brought intense scrutiny on global oil inventories. The primary goal of the OPEC-NOPEC oil production cuts is to bring inventories down to their five-year average levels. But the first six months of the cuts has made little progress toward this goal. The group extended the cuts, and OPEC has expressed confidence that stockpiles will be drawn down in coming months. But the slow pace has frustrated investors, and oil prices have weakened to levels not seen since August of last year.

In the U.S., crude inventories have been trending down at last, but the American Petroleum Institute (API) reportedly released information on Tuesday pointing to a surprise stock build last week. Prices had been strengthening until this news was released. The official data from the Energy Information Administration (EIA) will be released on Wednesday. If it corroborates the API numbers, prices are almost sure to slump.

Oil stocks are tracked closely in the Organization for Economic Co-operation and Development (OECD). The OECD has 35 member countries, including the United States, Canada, Mexico, Chile, Japan, South Korea, Australia, New Zealand, most of Western and Central Europe, Israel, and Turkey. Additional countries have expressed interest in OECD membership, including Colombia, Costa Rica, Argentina, Peru, Malaysia, Kazakhstan, and Croatia. The OECD accounts for the vast majority of global oil imports. It is sometimes viewed as the club representing oil importers, while OPEC is viewed as the club representing oil exporters, though the distinction is not exact.

As Figure 1 shows, the OECD maintains a fairly stable level of government-controlled oil stockpiles. The level has increased gradually from 1,585 mmbbls in the first quarter of 2014 to 1,598 mmbbls in the first quarter of 2017. This data is provided by the International Energy Agency (IEA).

In contrast, industry-controlled OECD stocks have grown significantly. In the first quarter of 2014, industry-controlled oil stocks were 2,579 mmbbls. In the third quarter of 2016, industry-controlled stocks had climbed to 3,061 mmbbls. Stocks fell to 2,985 mmbbls in the fourth quarter of 2017. However, in the first quarter of 2017, stocks increased once again, growing to 3,025 mmbbls. This stockpile growth occurred despite the high compliance levels OPEC achieved with the production cuts.

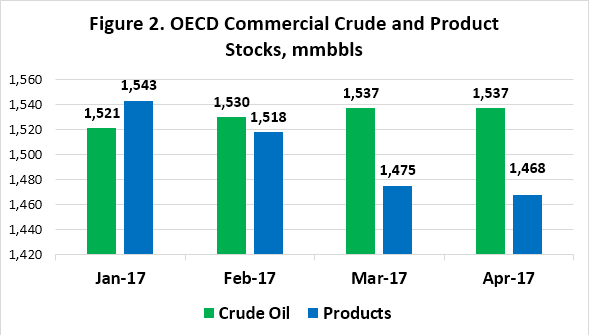

Figure 2 is based on OPEC data for the first four months of 2017. While the OPEC-NOPEC production cut participants have expressed confidence in their ability to drain global oil stockpiles, the drawdowns during the first four months of 2017 were achieved only in product stockpiles. Product stocks declined from 1,543 mmbbls in January to 1,468 mmbbls in April. Crude stocks, however, grew from 1,521 mmbbls in January to 1,537 mmbbls in April—heading in the wrong direction.

In short, OECD crude stockpiles continued to grow at a time when the market expected them to shrink. This has been a key cause of the slump in oil prices, and why the market criticized as inadequate OPEC’s decision to merely extend the existing production cuts, rather than deepening the cuts. If U.S. and other OECD country oil stockpiles grow once again, near-term prices are almost certain to sink. Many international agencies and analysts, however, tend to agree with the OPEC analysis: the production cut agreement is a long-term agreement, and its impacts will be felt in the second half of 2017.

This article is part of Crude

Tagged: OECD, OECD Inventories, oil inventories, OPEC cuts

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.