Nat Gas News – June 26, 2017

Nat Gas News – June 26, 2017

Mexico now dependent on U.S. natural gas for hitting emissions targets

Washington Examiner reports: Mexico is becoming increasingly dependent on U.S.-produced natural gas to keep its lights on and its emissions low, a Mexican official told U.S. energy regulators in Washington Thursday at an all-day meeting on energy security. U.S. natural gas is rapidly becoming important to Mexico’s manufacturing industry, while helping to both control emissions and manage the power grid as more renewables are included in the country’s electricity mix, Madrigal told FERC. Natural gas is seen as a necessary back-up for wind and solar power plants, which provide off-and-on power supplies as the wind blows and the sun shines. It also means that Mexico will become even more closely intertwined with states’ utility markets. For more on this story visit washingtonexaminer.com or click the following link http://washex.am/2sKe6JT

Weather Could Rescue Natural Gas Bulls Next Week

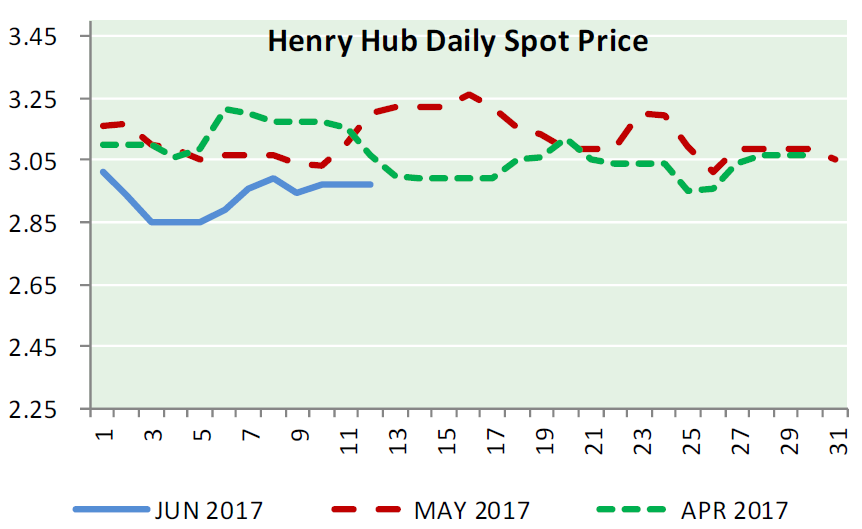

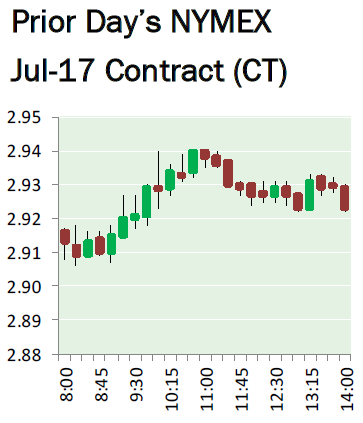

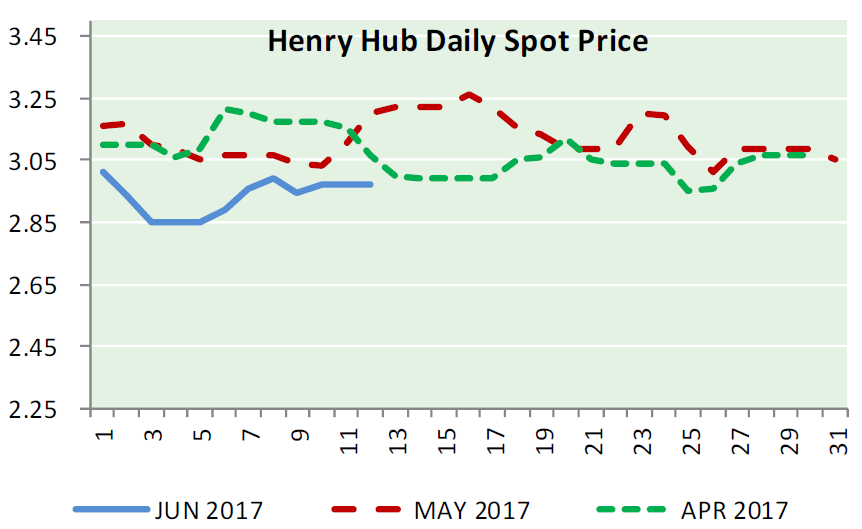

Market Realist reports: July US natural gas (FCG) (UNG) (GASL) futures contracts rose 0.4% and were trading at $2.90 per MMBtu (million British thermal units) in electronic trading at 3:10 AM EST on June 23, 2017. Prices rose due to short covering. July US natural gas futures contracts will expire on June 29, 2017. The next active August US natural gas futures contracts rose 0.3% and were trading at $2.92 per MMBtu in electronic trading at 3:10 AM EST on June 23, 2017. Weather forecasting agencies predict that temperatures will be milder than normal next week in the Great Lakes and eastern parts of the US. Tropical Storm Cindy could bring strong winds and rain to some parts of Texas and Louisiana. Overall, the weather is expected to be mild for the next few weeks. For more on this story visit marketrealist.com or click http://bit.ly/2rLfvP8

This article is part of Daily Natural Gas Newsletter

Tagged: Nat Gas Prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.