Nat Gas News – June 20, 2017

Nat Gas News – June 20, 2017

EQT to acquire Rice energy, become largest U.S. natural gas producer

The State Journal reports: EQT. Corp. has announced an agreement to acquire Rice Energy Inc. in a $6.7 billion deal that would make it the largest natural gas producer in the United States and triple EQT’s pipeline capacity to the Gulf. EQT will acquire 187,000 acres of Marcellus Shale from Rice in Pennsylvania. It also acquires 64,000 acres of Upper Devonian Shale in Pennsylvania, 105,000 acres of Utica Shale in Pennsylvania and 65,000 Utica Shale acres in Ohio. Rice has no acreage under its control in West Virginia. EQT would also acquire Rice’s midstream assets. Schlotterbeck said since the beginning of 2016 EQT has added more than 485,000 acres to its development portfolio. For more on this story visit theet.com or click the following link http://bit.ly/2stqNbU

EIA: Midwest states cling to coal as natural gas dominates other regional markets

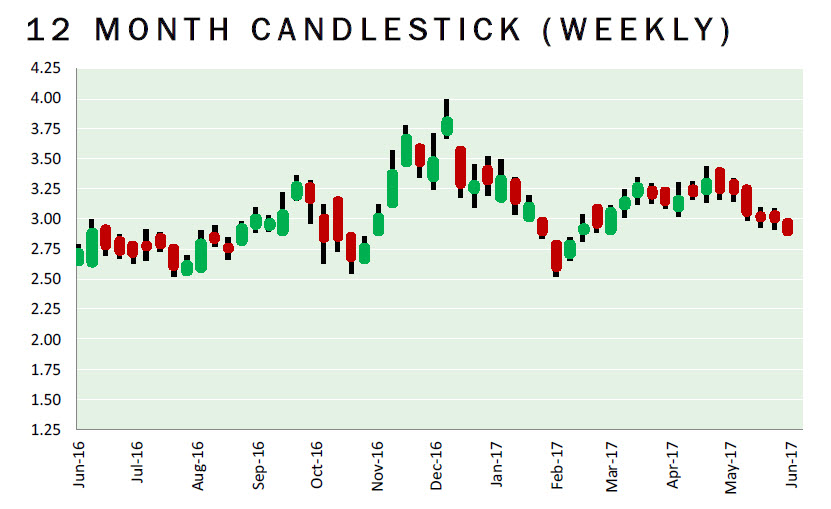

Utility Dive reports: While the Midwest continues to rely heavily on coal-fired power plants, gas plants are becoming the norm in almost every other region. The only state without a gas plant, EIA notes, is Vermont. In the near-term, the power mix is largely determined by natural gas prices. Coal generation exceeded gas this winter, as prices rose, but EIA believes that will again reverse over the hotter summer months. Total generation will be lower this June, July and August, compared with last summer, but EIA believes gas’ share will be about 34%, and coal’s about 32%. The Midwest is the only area of the country in which coal fuels more than half of summer electricity generation — about 54% according to EIA. For more visit utilitydive.com or click http://bit.ly/2stqbTE

This article is part of Daily Natural Gas Newsletter

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.