Nat Gas News – June 13, 2017

Nat Gas News – June 13, 2017

In the News

United States Remains the World’s Top Producer of Petroleum and Natural Gas Hydrocarbons

Energy Collective reports: The United States remained the world’s top producer of petroleum and natural gas hydrocarbons in 2016 for the fifth straight year despite production declines for both petroleum and natural gas relative to their 2015 levels. The United States has been the world’s top producer of natural gas since 2009, when U.S. natural gas production surpassed that of Russia. It has been the world’s top producer of petroleum hydrocarbons since 2013, when its production exceeded Saudi Arabia’s. For the United States and Russia, total petroleum and natural gas hydrocarbon production in energy content terms is almost evenly split between petroleum and natural gas.

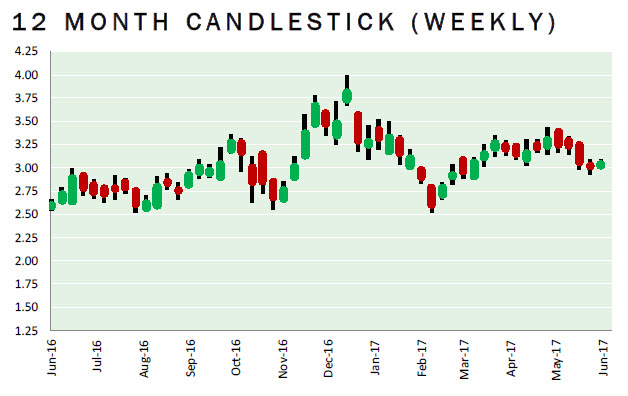

Natural Gas Prices Hold Support, Big Decline In Long Positions

Economic Calendar reports: Natural gas prices held above the key $3.00 per mBtu support level in US trading on Friday, although prices were unable to make any significant headway.The latest COT data recorded a very sharp decline in long, noncommercial positions for the second week running with a slide in the number of long contracts to just below 97,500 in the latest week from over 172,000 the previous week. This compares with a peak over 240,000 in the middle of May and was the lowest reading for three months. The sharp decline in long positioning will lessen the risk of further position liquidation in the short term and should offer some degree of protection to the market. Oil prices will be monitored closely this week and will have a significant impact on natural gas prices with a further focus likely on the $3.00 per mBtu level.

This article is part of Daily Natural Gas Newsletter

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.