Weekly Price Review

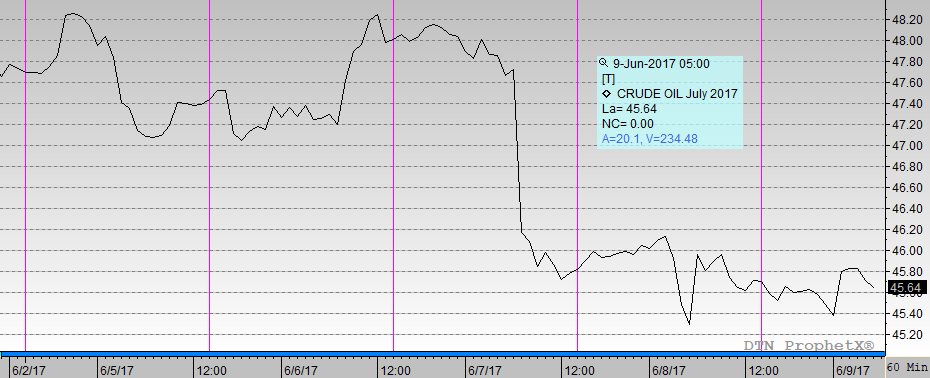

Oil prices declined significantly this week, for the second week in a row. Many traders had hoped for a more dramatic outcome from the May 25th OPEC-NOPEC meeting, and prices began to falter when the group stayed with the original idea of appending an extension to the existing production cut agreement. This week, the supply-demand fundamentals were weak, and prices dropped anew. WTI is below the $46/b level, but the $45/b price floor has been holding. WTI opened at $45.71/b today, a drop of $0.14, or 0.31%, below yesterday’s opening price. This week appears to be the third week in a row that prices will end in the red.

WTI crude prices opened the week at $47.71/b. WTI opened this session at $45.71/b, a drop of $2.00, or 4.2%, from Monday’s opening. During the week, prices ranged from a low of $45.39/b on Friday to a high of $48.42/b on Monday, a range of $3.22. Current prices are $45.70/b, up by $0.06 from yesterday’s closing price.

Diesel prices opened Monday at $1.4835/gallon. Diesel opened this morning at $1.4255/gallon, a significant drop of 6.1 cents, or 4.1% for the week. Prices ranged from a low of $1.4098/gallon on Thursday to a high of $1.5031/gallon on Monday, a large price range of 9.33 cents. Current prices are $1.4251/gallon, up by 0.28 cents from yesterday’s closing price.

Gasoline prices opened Monday at $1.577/gallon. Gasoline opened today at $1.4619/gallon, a major drop of 8.51 cents, or 5.4%, for the week. Prices ranged from a low of $1.4782/gallon on Friday to a high of $1.5905/gallon on Monday, a large range of 11.23 cents. Prices are $1.4942/gallon currently, up by 0.23 cents from yesterday’s close.

This week’s sharp downward price movement came after the Energy Information Administration (EIA) released the official U.S. weekly supply data. The industry had been expecting another drawdown in crude stockpiles, as much as 4.6 mmbbls according the American Petroleum Institute (API).

In a serious reversal, the EIA instead reported a stock build of 3.295 mmbbls. Until this past week, crude stocks had been drawn down for eight weeks in a row, consistent with the ramping up of refineries, the seasonal increase in gasoline demand, and the supposed trend toward a better supply-demand balance. The unexpected addition to inventories came as a shock to the market.

The EIA also reported a diesel stock build of 4.355 mmbbls, plus a gasoline stock build of 3.324 mmbbls. Last week, the EIA reported a gasoline stock draw of 2.9 mmbbls, which was the largest drawdown in a four-week streak of gasoline inventory draws.

The weekly supply data reported that apparent gasoline demand rose by 118 kbpd during the week leading up to Memorial Day (the week ended May 26th), but it plummeted by 505 kbpd during the week after (the week ended June 2nd). Diesel demand also dropped by 520 kbpd.

In last Friday’s Weekly Price Review article, we raised the question:

“Indeed, without some sort of market tightening, analysts may once again start noting technical support levels for the next downward price correction. Recall that as recently as May 5th, WTI opened at $45.51/b. What stands in the way of a return to this price?”

The prediction was correct, but reasons we contemplated were more long-term. One week of data does not define a long-term trend, but the unexpected additions to stockpiles and the weak demand launched a serious sell-off.

This article is part of Crude

Tagged: fuel prices, oil prices, OPEC cuts

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.