Today’s Market Trend

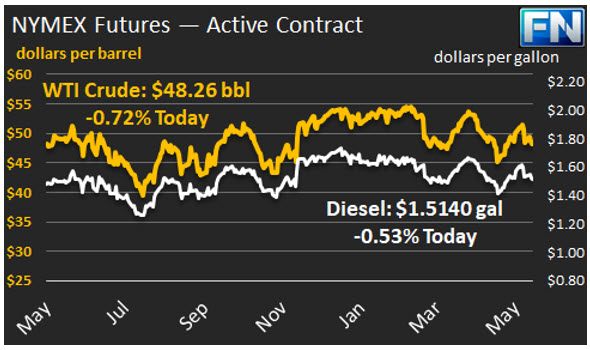

WTI crude prices are approximately $48.25-$48.50/b this morning. Yesterday, prices continued to weaken, falling as low as $47.73 before recovering modestly to close at $48.32/b. WTI opened at $48.63/b today, a drop of $1.02, or 2.05%, below yesterday’s opening price. Current prices are $48.26/b, down by $0.06 below yesterday’s closing price.

Diesel opened at $1.5234/gallon this morning. This was a decline of 2.89 cents (1.86%) below yesterday’s opening price. Current prices are $1.5140/gallon, down by 0.39 cents from yesterday’s closing price.

Gasoline opened at $1.6051/gallon today, a significant drop of 3.49 cents, or 2.13%, from yesterday’s opening. Prices are $1.6022/gallon currently, up 0.57 cents from yesterday’s close.

The downward trend in prices yesterday was slowed largely because of a potentially large drawdown in crude inventories. The API data for the week reportedly showed a major drawdown of 8.67 mmbbls, versus the Schneider Electric industry survey expectation of 2.5 mmbbls. The API data also showed a gasoline inventory draw of 1.73 mmbbls, versus the industry expectation that stocks would remain unchanged. The API anticipates a diesel stock build of 0.124 mmbbls, versus the industry survey expectation of a 0.3-mmbbl drawdown. The official EIA data will be released later today.

Many analysts and investors have reduced their forecasts of oil prices for 2017 and 2018, believing now that WTI crude will have a difficult time reaching and exceeding $50/b. Gasoline prices rose in May, but will likely ease once again if WTI prices continue to slide. The EIA noted that gasoline prices leading up to Memorial Day were higher than they were last year, but they were the second-lowest since 2009. The EIA cites low crude prices, high inventories, and low demand as the key reasons for low gasoline prices. The EIA’s analysis follows as our second article today.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.