Weekly Price Review

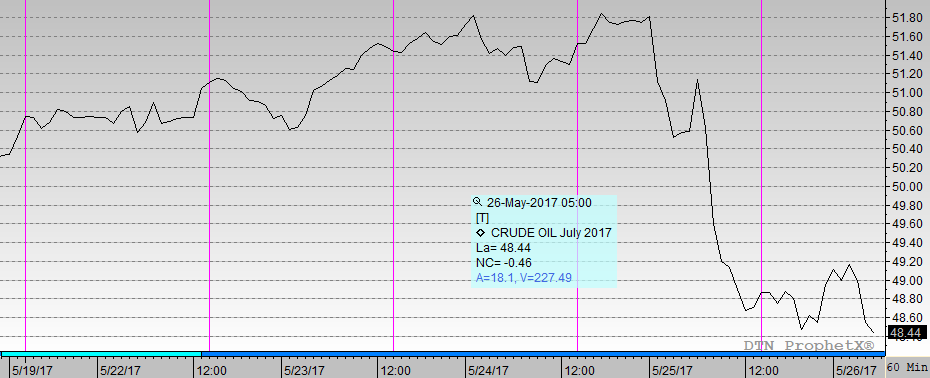

It was a volatile week for the oil complex. Prices reacted to OPEC announcements leading up to the formal meeting on Thursday. The announcements were generally confident, and the participants appeared to reach consensus for the adoption of a nine-month extension to the production cut agreement. Prices were on a general upward trend. Yet when the meeting concluded with the expected agreement, prices collapsed. WTI is back below the $49/b level.

WTI opened at $48.75/b today, a major drop of $2.50, or 4.88%, below yesterday’s opening price. The price gains of the week have been erased, and the week appears to be heading for an end in the red. This morning, crude prices are bouncing along a rocky floor of $48.20-$49.10/b.

WTI crude prices opened the week at $50.06/b. WTI opened this session at $48.75/b, a large drop of $2.50, or 4.88%, from Monday’s opening. During the week, prices ranged from a low of $48.18/b on Friday to a high of $52.00/b on Thursday, a range of $3.82. Current prices are $48.42/b, a continued decline of $0.48 below yesterday’s closing price.

Diesel prices opened Monday at $1.5888/gallon. Diesel opened this morning at $1.5471/gallon, a significant drop of 6.05 cents, or 3.76% for the week. Prices ranged from a low of $1.53/gallon on Friday to a high of $1.6269/gallon on Thursday, a large price range of 9.69 cents. Current prices are $1.5341/gallon, a decrease of 1.68 cents from yesterday’s closing price.

Gasoline prices opened Monday at $1.6549/gallon. Gasoline opened today at $1.6105/gallon, a decrease of 4.44 cents, or 2.68%, for the week. Prices ranged from a low of $1.5973/gallon on Thursday to a high of $1.675/gallon on Wednesday, a range of 7.77 cents. Prices are $1.6020/gallon currently, down 0.73 cents from yesterday’s close.

The market was disappointed that the OPEC-NOPEC producers did not go above and beyond the call to cut the supply overhang. The group decided that the current arrangement would suffice. Many analysts and investment houses agree. In fact, some have cautioned that the market is already rebalancing, and that it even runs the risk of being caught short because of a lack of investment in the upstream sector.

At the other end of the spectrum, however, there is a concern that global oversupply could easily linger. Oversupply concerns remain as before: the fact that OPEC members Libya and Nigeria remain exempt from cuts and have announced their determination to expand production, the possibility that come of the participating OPEC-NOPEC members will gradually reduce compliance with the agreed cuts, and the trend of rising crude production from other crude producers, chiefly the United States.

On the U.S. side, the supply and demand data were constructive last week. For the third week running, the Energy Information Administration (EIA) has reported across-the-board inventory drawdowns: 4.432 mmbbls of crude, 0.787 mmbbls of gasoline, and 0.485 mmbbls of diesel. The crude drawdown greatly exceeded industry expectations.

Rising U.S. supply continues to blunt OPEC efforts. According to the EIA, U.S. crude supply expanded by 15 kbpd during the week ended May 19th. Crude imports decreased, but crude exports decreased as well, leaving a net surplus. Additional crude supply fed an increase in refinery utilization. Crude inputs to refining rose by 159 kbpd.

Apparent demand for gasoline rose by 252 kbpd during the week, while diesel demand rose by 144 kbpd, and jet fuel demand fell by 263 kbpd. The EIA reported that the U.S. gasoline supplies are abundant and prices are moderate moving into Memorial Day weekend. According to the EIA, “Relatively low crude oil spot prices, weaker year-over-year gasoline demand, and high gasoline inventories are all putting downward pressure on gasoline prices.”

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.