Stable crude prices, weaker demand, and high inventories moderate gasoline prices heading into Memorial Day

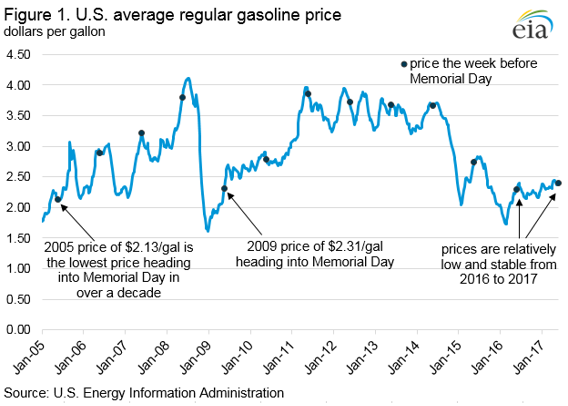

Gasoline prices heading into the 2017 Memorial Day weekend average $2.40 per gallon (gal) nationally, up from last year’s price of $2.30/gal before the holiday weekend. Despite the year-over-year increase, 2017 marks the second-lowest price ahead of the Memorial Day weekend since 2009, when the national average price of regular gasoline was $2.31/gal (Figure 1). Relatively low crude oil spot prices, weaker year-over-year gasoline demand, and high gasoline inventories are all putting downward pressure on gasoline prices.

The price of gasoline typically increases during spring due to the switch from winter-grade to more expensive summer-grade gasoline. This year, unlike many recent ones, prices have remained relatively stable as Memorial Day approaches.

U.S. gasoline prices are more closely tied to Brent crude oil prices than to West Texas Intermediate prices. Brent has been relatively stable in 2017, trading within an eight-dollar weekly average range. In addition, Brent spot prices have been low compared with recent history and are $23 below the three-year average as of May 19.

Gasoline demand has fallen from last year, putting further downward pressure on prices. As of May 19, the four-week average U.S. demand is 178,000 barrels per day (b/d), approximately 2%, below 2016 levels. Despite declining demand in 2017 so far, AAA (in association with IHS Markit) expects over 39 million Americans to travel this weekend, 1 million more travelers than last year and the highest travel volume since 2005.

High inventories, including finished gasoline and gasoline blending components, are also contributing to the downward pressure on gasoline prices. Gasoline inventories have been averaging near 2016 levels (near the upper bound of the five-year range), rising above last year’s levels for two weeks recently before dipping to 239.9 million barrels, slightly less than the 2016 inventory levels of 240.1 million barrels. This trend corresponds with strong refinery and blender net production of finished motor gasoline, which has been equal to or greater than 2016 4-week average levels for 10 straight weeks.

Retail gasoline prices vary significantly within the United States because of regional supply and demand balances, gasoline specification requirements, and taxes (Figure 2). Petroleum Administration for Defense District (PADD) 3 (Gulf Coast), which has approximately 50% of U.S. refining capacity and produces more gasoline than it consumes, typically has the lowest retail gasoline prices in the country. PADD 5 (West Coast) retail gasoline prices are often above the average U.S. price because of the region’s tight supply and demand balance, isolation from additional supply sources, and gasoline specifications that are more costly to meet. Average Gulf Coast and West Coast prices are, respectively, 25 cents/gal below and 53 cent/gal above the national average price.

Through May 22, U.S. regular gasoline prices, as measured in EIA’s weekly retail survey, have averaged $2.36/gal in 2017. EIA expects the 2017 summer season (April through September) gasoline price to average $2.39/gal, 16 cents higher than last summer. U.S. regular gasoline prices are forecast to average $2.34/gal in 2017 and $2.45/gal in 2018 (Figure 3).

This article is part of Gasoline

Tagged: gas prices, Memorial Day

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.