Nat Gas News May 22, 2017

Nat Gas News – May 22, 2017

In the News

The Future of Natural Gas Development on the Western Slope

WesternSlopeNow.com reports: Around 35% of Colorado is federally owned land, managed by agencies like the National Forest Service, National Park Service, and the Bureau of Land Management. The Western Slope is a resource rich area, specifically in natural gas. A recent decision allowing natural gas exports to flow to China may create new opportunities in the energy sector. And out here in the Grand Valley, this means that natural gas organizations could soon be competing for some of the resource rich public lands in the area. The Mancos Shale Formation in the Piceance Basin is estimated to contain 66 trillion cubic feet of shale natural gas and 45 million barrels of natural gas liquids. Meaning the Western Slope could be the home to the second largest reserve of natural gas in the country. According to the BLM, the Oil and Gas industry supports 13,401 jobs on BLM managed lands in Colorado alone. They also generate around $3.5 billion dollars of economic contributions on these lands in Fiscal Year 2015. For more on this story visit westernslopenow.com or click http://bit.ly/2rmNjoA

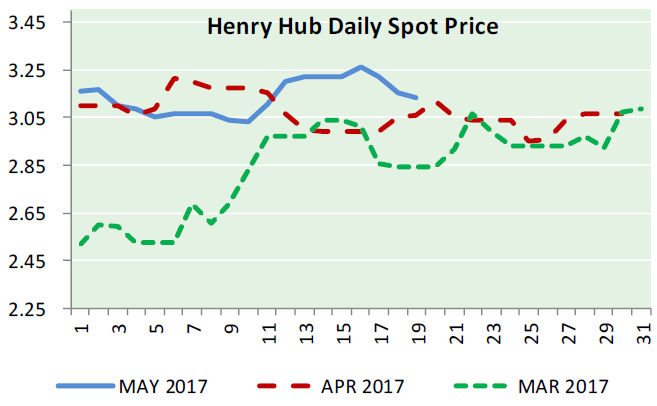

Natural Gas Prices End the Week with a Solid Rebound since January

Economic Calendar reports: Contract for June delivery on the New York Mercantile Exchange traded higher in today’s session. As a result of the decline into Thursday’s $3.16 low, natural gas prices came within reach of key support at the April 25th $3.13 bottom, which was reinforced by the failed test which took place with May 8th’s move to $3.14 for a low. All of these factors combined set the stage for a bounce in natural gas prices in today’s session. And, with the Stochastic still well below an overbought level and initial resistance above current prices, the path of least resistance heading into next week is to the upside. For more on this story visit economiccalendar.com or click http://bit.ly/2pTLHDb

This article is part of Daily Natural Gas Newsletter

Tagged: natural gas, prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.