Will States Take the Lead in Raising Fuel Taxes for Infrastructure?

Last week, we wrote about California’s new law raising taxes on gasoline and diesel, plus instituting new fees on vehicles, in order to raise funds for transportation infrastructure. California’s tax increase will be a 12-cents-per-gallon excise tax on gasoline, a 20-cents-per-gallon excise tax on diesel and an additional 4% increment sales tax on diesel, to start November 1, 2017. The California bill also proposes a new Transportation Improvement Fee (TIF), which escalates based on the market value of vehicles. It also proposes a Road Improvement Fee of $100 per vehicle for zero-emission vehicles (ZEVs), which have been exempt from certain fees to promote their adoption.

The California bill was supported strongly by Democratic Governor Jerry Brown. A Republican assemblyman, Travis Brown, immediately filed an initiative to repeal the law and move it to a vote in 2018.

Now, South Carolina’s Legislature has voted to raise their state gasoline tax for the first time since 1987. The new law, HR 3516, will raise the tax by 12 cents over six years, reaching a total tax of 28.75 cents per gallon. The Republican Governor, Henry McMaster, vetoed the bill. Governor McMaster had wished to pursue an option requesting nearly $5.2 billion from the federal government and issuing over $1 billion in state bonds. Legislators opposed this because it would have required the state to repay the money in the future along with interest.

Within one day of the governor’s veto, South Carolina’s House of Representatives and Senate both voted yesterday to overrule him, in a show of bi-partisan strength. The final vote in the House was 95-18, and the final vote in the Senate was 32-12. The new law is fully approved. The first 2 cents of the 12-cent increase at the pump will take effect July 1st. The bill’s supporters have estimated that this bill will raise funding for South Carolina state roads by approximately $600 million per year, once the tax increase and other fees are phased in completely.

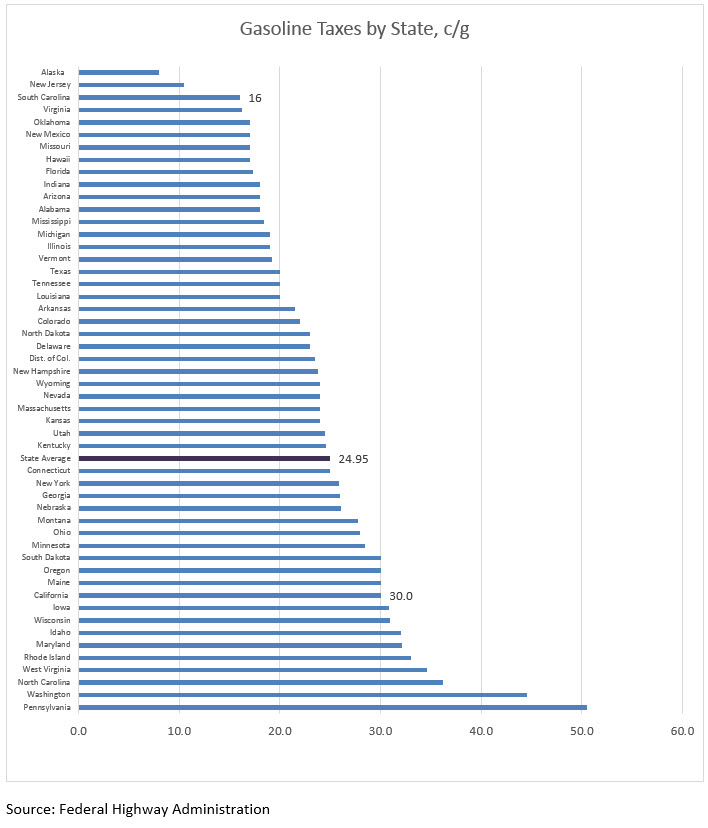

The South Carolina tax increase is modest when compared to the California tax increase. In addition, South Carolina’s tax is one of the lowest in the country at 16 cents per gallon. California’s tax is 30 cents per gallon. The state average is 24.95 cents per gallon. The figure below provides 2015 state gasoline taxes as reported by the Federal Highway Administration. There is a wide range of state taxes, ranging from a low of 8 cents per gallon in Alaska to a high of 50.5 cents per gallon in Pennsylvania. The difference in taxes sometimes prompts motorists to purchase fuel in one state before crossing a border into a more highly taxed state. As a practical side note for fuel marketers and fuel purchasers, any increase in state motor fuel taxes may cause a surge in fuel buying at stations just before the border crossing.

Raising fuel taxes is always a contentious issue. Proposing them often is considered akin to political suicide. Unfortunately, this leaves many transport infrastructure projects unfunded. The recent examples in California and South Carolina raise the question, will States take the lead in raising taxes to fund transport infrastructure?

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.