Today’s Market Trend

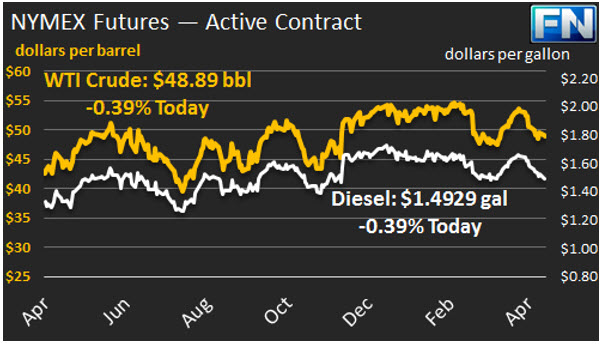

WTI crude prices are slightly below $49/b this morning. Prices are essentially unchanged from yesterday, though early morning trading brought a price spike to $49.26/b, which then subsided. WTI opened at $48.78/b today, a drop of $0.39, or 0.79%, below yesterday’s opening price. Current prices are $48.89/b, $0.05 above yesterday’s closing price. WTI crude prices have opened lower in nine of the last thirteen trading sessions, falling by 8.7% ($4.62/b) since April 12th. Product prices also weakened yesterday, continuing their downward trend, then spiked briefly in early morning trading today.

Diesel opened at $1.4861/gallon in today’s trading session. This was a decline of 2.01 cents (1.33%) below yesterday’s opening price. Current prices are $1.4929/gallon, a recovery of 0.51 cents from yesterday’s closing price. Diesel prices have opened lower for twelve of the last thirteen trading sessions, shedding 16.84 cents, or 10.2%, since April 12th.

Gasoline opened at $1.5245/gallon today, down 2.36 cents, or 1.52%, from yesterday’s opening. Prices are $1.5391/gallon currently, a recovery of 1.19 cents from yesterday’s close. Gasoline prices have decreased in twelve of the last thirteen trading sessions, dropping by a total of 23.94 cents, or 13.6%, since April 12th.

Most key international agencies expect that the second half of 2017 will bring global supply and demand into balance. Yet the process is slower than many forecast, because improvements in supply-demand fundamentals in some areas are offset by widening imbalances elsewhere. Most recently, the Libyan National Oil Company (NOC) reported that Libyan crude production has surged above 760 kbpd, nearly twice the level of one year ago. OPEC reported that Libya’s crude production in March was 622 kbpd. Libya is not a participant in the OPEC production cut agreement. The increases in Libyan output, when combined with the increases in U.S. output, are undermining the cuts made by the OPEC-Non-OPEC participants.

On the demand side, U.S. demand is not growing as many had forecast, and the latest Chinese economic data suggest that its rapid growth may be slowing. In a surprising move counter to the Chinese manufacturing data, British manufacturing jumped to its fastest rate in three years. The Pound Sterling opened higher this morning, though its future remains unknown as Brexit negotiations continue.

The EIA has released data on gasoline and diesel retail prices for the week ended May 1st. At the national level, gasoline retail prices dropped significantly, by 3.8 cents/gallon, and diesel prices declined by 1.5 cents/gallon. Details follow in our second article.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.