Weekly Price Review

Crude prices this week continued on a downward path this week, punctuated by a sharp downward price movement on Thursday that hit the bottom at $48.20/b before gradually climbing back above $49/b by the close of trading. The sharp decline caused some analysts to ponder whether breaking through key technical supports would signal a larger drop below $47/b/. WTI opened at $49.27/b today, a small increase of $0.05, or 0.10%, below yesterday’s opening price. WTI crude prices are trending up this morning, so it is possible that the week’s losses will be erased. Product prices also are trending up this morning, but their losses this week have been substantial, so it would take a significant buying surge today to prevent ending the week in the red again.

WTI crude prices opened the week at $49.68/b. WTI opened this session at $49.27/b, a decline of $0.41, or 0.8%, from Monday’s opening. During the week, prices ranged from a low of $48.20/b on Thursday to a high of $50.22 on Monday, a narrow range of $2.02. Current WTI prices are $49.52/b, $0.55 above yesterday’s closing price.

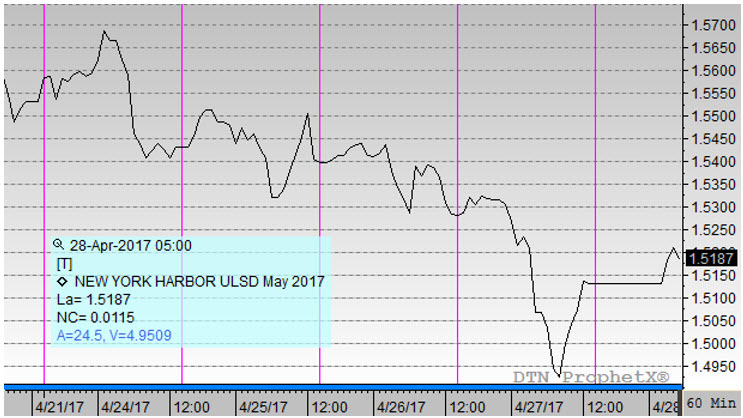

Diesel prices opened Monday at $1.5557/gallon. Diesel opened this morning at $1.5162/gallon, a drop of 2.5%, or 3.95 cents, for the week. Prices ranged from a low of $1.4909/gallon on Thursday to a high of $1.5705/gallon on Monday, a large price range of 7.96 cents. Prices currently are $1.521/gallon, up by 1.38 cents from yesterday’s closing price.

Gasoline prices opened Monday at $1.6416/gallon. Gasoline opened today at $1.5553/gallon, a large drop of 5.3%, or 8.63 cents, for the week. Prices ranged from a low of $1.539/gallon on Thursday to a high of $1.6554/gallon on Monday, a wide range of 11.64 cents. Prices are $1.5831/gallon currently, a significant recovery of 3.31 cents from yesterday’s close.

During the week, U.S. market indicators came out mixed. Prices were supported Monday when Schneider Electric’s industry survey predicted across-the-board crude and product inventory drawdowns. Prices weakened when the API numbers showed a build in crude and gasoline stocks, plus only a minuscule draw on diesel stocks.

The official EIA data confounded both sets of expectations. The EIA reported a crude inventory drawdown of 3.64 mmbbls, but major additions to product inventories. Diesel inventories rose by 2.651 mmbbls, and gasoline inventories rose by 3.369 mmbbls.

Part of the crude stock draw can be explained by the surge in refinery activity. Net crude inputs to refining jumped by 347 kbpd. This might have been interpreted as a bullish sign, except that demand did not rise to absorb the additional product. The EIA data reported that apparent weekly demand fell by an average of 330 kbpd. At this time of year, diesel demand often wanes, but gasoline demand is expected to rise. So far, this has not occurred, despite widespread forecasts that gasoline demand will be strong in 2017’s summer driving season.

Adding to supply concerns, Bloomberg reported that Libya’s Sharara oilfield resumed production after a nearly two-week outage. Force majeure was lifted by the National Oil Company (NOC,) and the pipeline leading to the Zawiya refinery and export terminal has been re-opened. The NOC hopes to expand production from the Sharara field to 270 kbpd later this year.

While the majority of the market fundamentals were bearish for prices, prices have rebounded today. Three possible explanations suggest themselves to us: First, the announcement by Russia that it has met its production cut commitment, and that an extension of the OPEC production cut agreement appears more likely. Second, economic optimism over the proposed cut in the U.S. corporate tax rate, and the posting of corporate earnings. The Down Jones Industrial Average is once again touching upon 21,000. Third, there may be a resurgence of geopolitical risk based on yesterday’s exclusive interview by Reuter’s with President Trump, where the President stated “There is a chance that we could end up having a major, major conflict with North Korea. Absolutely.”

This article is part of Uncategorized

Tagged: Weekly Price Review

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.