Today’s Market Trend

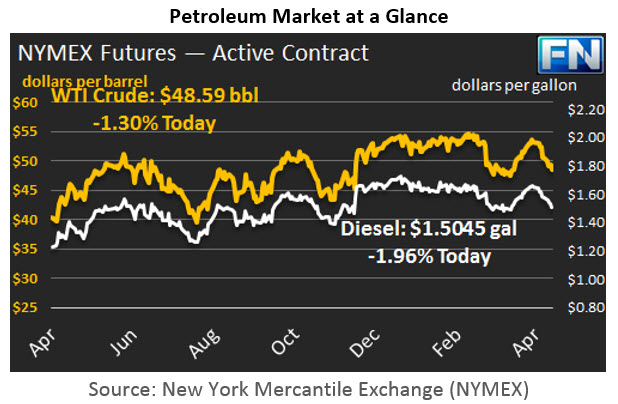

WTI crude prices slumped below $49/b this morning, and prices are currently in the $48.50-$48.75/b range. Over the past two days, WTI prices had dipped below $49/b briefly, but they regained the $49/b mark before market closing. WTI opened at $49.22/b today, a relatively modest decrease of $0.14, or 0.28%, below yesterday’s opening price. But prices continued to fall overnight, and current WTI prices are $48.59/b, $1.03 below yesterday’s closing price. WTI crude prices have opened lower in seven of the last ten trading sessions. Product prices also weakened yesterday and dropped sharply overnight.

Diesel opened at $1.5284/gallon in today’s trading session. This was a drop of 1.21 cents (0.79%) above yesterday’s opening price. Current prices are $1.5045/gallon, down by 3.22 cents from yesterday’s closing price. Diesel prices have opened lower for nine of the past ten trading sessions, dropping by 12.61 cents, or 7.6%, since April 12th. Diesel prices are at their lowest point in a month.

Gasoline opened at $1.5793/gallon today, down 2.52 cents, or 1.57%, from yesterday’s opening. This was the lowest opening price since February 28th. Prices are $1.5518/gallon currently, down by 3.85 cents from yesterday’s close. Gasoline prices have decreased in nine of the past ten trading sessions, dropping by a total of 18.46 cents, or 10.5%, since April 12th.

The EIA released the official weekly supply data yesterday, and the data on inventories differed hugely from market expectations. The EIA reported a crude inventory drawdown of 3.64 mmbbls—the largest drawdown of the year. In fact, there have been only three weeks with inventory drawdowns this year, totaling 3.44 mmbbls. This week’s drawdown of 3.64 mmbbls more than doubles the year’s stock draw to date. Part of the draw is explained by the surge in refinery activity. Net crude inputs to refining jumped by 347 kbpd, which added to refined product output. This might have been interpreted as a bullish sign, except that demand did not rise to absorb the additional product. The EIA data reported that apparent weekly demand fell by an average of 330 kbpd. More product flowed into storage. Diesel inventories rose by 2.651 mmbbls, and gasoline inventories rose by 3.369 mmbbls.

As noted yesterday, the Schneider Electric survey indicated across-the-board stock draws (2.3 mmbbls crude, 0.125 mmbbls gasoline, and 2.0 mmbbls diesel.) The API data then reportedly showed a crude stock build of 0.897 mmbbls, a diesel stock draw of 0.036 mmbbls, and a gasoline build of 4.445 mmbbls. The official EIA data confounded both sets of expectations. With crude stocks finally drawn down and product stocks rising, the oil complex weakened. At this time of year, diesel demand often wanes, but gasoline demand is expected to rise. So far, this has not occurred, despite widespread forecasts that gasoline demand will be strong in 2017’s summer driving season.

The low prices may re-stimulate demand. The National Association of Convenience Stores (NACS) recently conducted a consumer survey that revealed 84% of consumers say that low gasoline prices are good for the economy. Details follow in our second article today.

This article is part of Crude

Tagged: diesel, gasoline, WTI prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.