Today’s Market Trend

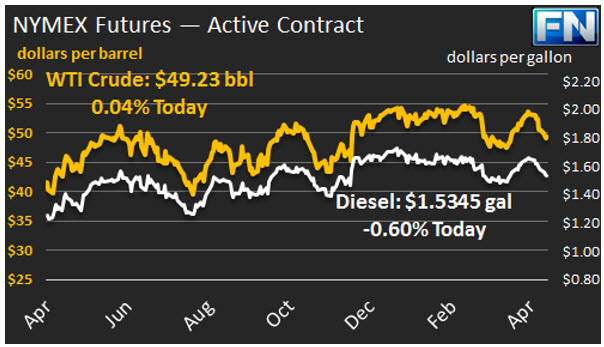

WTI crude prices have remained in the $49.00-$49.50/b range this morning. Prices yesterday dipped below $49/b briefly, but recovered to close the day at $49.56/b. WTI opened at $49.36/b today, an increase of $0.14, or 0.28%, above yesterday’s opening price. Current prices are $49.23/b, $0.33 below yesterday’s closing price. WTI crude prices have opened lower in six of the last nine trading sessions, causing technical analysts to ponder whether prices might break through key resistance points and continue to spiral down to $47/b. Product prices also remained weak yesterday, with diesel prices flat and gasoline continuing to decline.

Diesel opened at $1.5405/gallon in today’s trading session. This was a very small increase of 0.05 cents (0.03%) above yesterday’s opening price. Current prices are $1.5345/gallon, down by 1.07 cents from yesterday’s closing price. Until this morning diesel prices had opened lower for eight consecutive trading sessions, but early morning trading has eliminated the small gain seen at opening.

Gasoline opened at $1.6045/gallon today, down 1.7 cents, or 1.05%, from yesterday’s opening. Prices are $1.5997/gallon currently, down significantly by 2.33 cents from yesterday’s close. Gasoline prices have decreased in eight of the past nine trading sessions, dropping by a total of 15.94 cents, or 9%, since April 12th.

Schneider Electric’s survey of analysts yesterday indicated across-the-board stock draws of 2.3 mmbbls crude, 0.125 mmbbls gasoline, and 2.0 mmbbls diesel. The API data reportedly shows a crude stock build of 0.897 mmbbls, a diesel stock draw of 0.036 mmbbls, and a major build of 4.445 mmbbls of gasoline. Gasoline prices have fallen to their lowest levels in four weeks. The official EIA data on oil stocks is scheduled for release later today. A close match with the API information is expected to pressure gasoline prices down. However, this may be partially offset if upcoming weekly demand figures are up, as is often the case after the Good Friday/Easter holiday weekend.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.