Today’s Market Trend

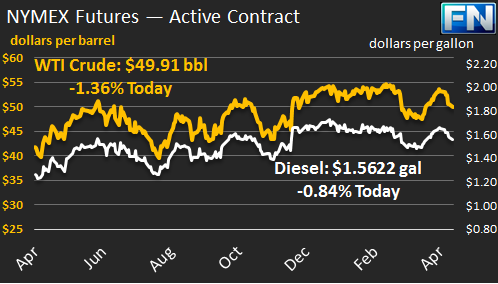

WTI crude prices have retreated below $50/b this morning. WTI opened at $49.68/b today, a drop of $1.03, or 2.03%, below Friday’s opening price. Current prices are $49.91/b, $0.29 above Friday’s closing price. Product prices also dropped on Friday, then leveled off and opened slightly higher this morning.

Diesel opened at $1.5557/gallon in today’s session. This was a decline of 2.33 cents (1.48%) below Friday’s opening price. Current prices are $1.5622/gallon, up by 0.89 cents from Friday’s closing price.

Gasoline opened at $1.6416/gallon today, down 2.67 cents, or 1.6%, from yesterday’s opening. Prices are $1.6473/gallon currently, up by 0.28 cents from yesterday’s close.

Friday’s market opened with crude and product prices down, and they were heading to finish the week in the red. Prices continued to weaken during the day. Crude ended the day down by over a dollar per barrel, diesel prices dropped by 2.57 cents/gallon, and gasoline prices dropped by 2.38 cents/gallon.

Supply-demand balance concerns appeared to be on the rise. The EIA data for the week had shown an increase in U.S. crude production of 17 kbpd, and the Baker Hughes Rig Count data released on Friday showed an addition of 10 active rigs, bringing the total to 857. This is the highest active rig count since the week of September 4th, 2015.

The possibility of an extension to the OPEC-NOPEC production cut agreement has helped support prices. Market faith in the extension appeared to weaken last week, but this morning, it may be reviving. On Thursday, Saudi Arabia’s Oil Minister, Khalid al-Falih, stated that six OPEC members so far favor an extension of the cuts: Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Oman and Bahrain. It may be no coincidence that these six countries are also the founding members of the Gulf Cooperation Council (GCC,) which was founded in 1981 as the “Cooperation Council of the Arab States of the Gulf.” These are the key Arab states bordering the Persian Gulf, excluding Iraq. An extension would need full consensus, including Iraq and Iran. It is also possible that an extension might not be the same as the original agreement. It might not be a six-month term, for example, and the allocation of cuts might be different.

The production cut agreement has been successful so far. Over the weekend, the OPEC-NOPEC technical committee reported that the compliance level had hit 98% in March. The OPEC participants had exceeded their pledged cuts, achieving 103% compliance. The committee recommends an extension of the cuts.

This article is part of Crude

Tagged: diesel, gasoline, OPEC deal extension, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.