Weekly Price Review

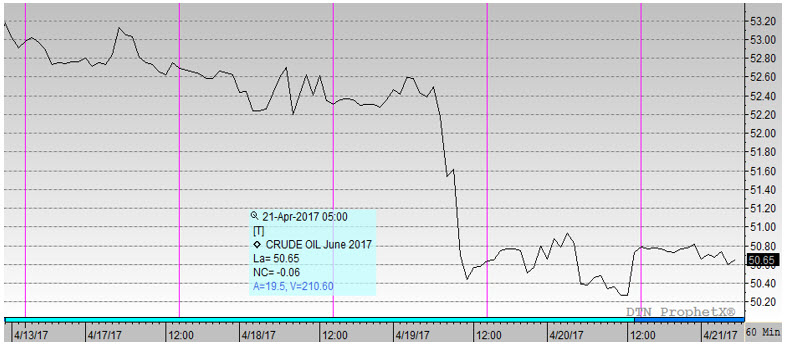

Crude prices this week were trending down gently until Wednesday morning, when the oil complex experienced a sharp downward price correction. Last week’s price gains had come about partly because of increased geopolitical risk, heightened by North Korea’s missile tests and aggressive language all around. But the market discounted the risk this week. Prices began to fade, slowly at first, then with a sharp plunge as other fundamentals and technicals prompted selling. WTI prices tested some lows on Wednesday, almost breaking down below $50/b again. Product prices also collapsed on Wednesday, then leveled off on Thursday and this morning. The week is heading to an end in the red, though the increasing likelihood of an extension of the OPEC-NOPEC production cut agreement is helping keep prices above $50/b. Overall, prices are back where they were at the beginning of the month.

WTI crude prices opened the week at $52.97/b. WTI opened this session at $50.71/b, a major drop of $2.26, or 4.3%, from Monday’s opening. During the week, prices ranged from a low of $50.09/b on Wednesday to a high of $53.21 on Monday, a range of $3.12. Current prices are $50.60/b, down $0.11 from yesterday’s close.

Diesel prices opened Monday at $1.647/gallon. Diesel opened this morning at $1.579/gallon, a large drop of 4.1%, or 6.8 cents, for the week. Prices ranged from a low of $1.5696/gallon on Wednesday to a high of $1.6314/gallon on Monday, a large price range of 8.09 cents. Prices currently are $1.5755/gallon, slightly down by 0.034 cents from yesterday’s closing price.

Gasoline prices opened Monday at $1.7333/gallon. Gasoline opened today at $1.6683/gallon, a large drop of 3.8%, or 6.5 cents, for the week. Prices ranged from a low of $1.65/gallon on Wednesday to a high of $1.7413/gallon on Monday, a large range of 9.13 cents. Prices are $1.6724/gallon currently, up slightly by 0.19 cents from yesterday’s close.

During the week, prices were supported Monday when Schneider Electric’s industry survey predited a crude stock draw and significant product inventory drawdowns. The API numbers were less optimistic, showing a drawdown of crude and diesel, but a build of gasoline. The official EIA data was released later Tuesday, and it largely corroborated the API numbers. The data reported a crude stock draw of 1.034 mmbbls, a diesel stock draw of 1.955 mmbbls, and an unexpected gasoline stock build of 1.542 mmbbls.

The EIA numbers also showed a drop in demand amounting to 439 kbpd of refined products, including 52 kbpd of gasoline and 458 kbpd of diesel. Domestic fuel production increased, however, with an additional 241 kbpd of crude runs. The softening of the supply-demand balance contributed to the downward price movement. Still, it was not so dramatic that it was the only factor at work. Goldman Sachs concludes that the selloff was driven by technicals rather than fundamentals.

This article is part of Uncategorized

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.