Today’s Market Trend

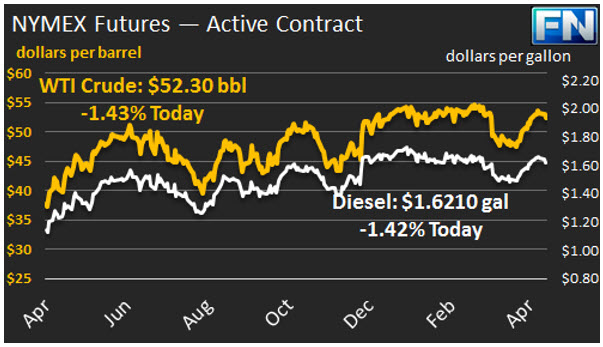

WTI crude prices retreated to the $52.00-$52.50/b range this morning. Yesterday morning brought a price surge, followed by a sell-off that continued overnight. WTI opened at $52.75/b today, a decrease of $0.22 below Thursday’s opening price. Current prices are $52.30/b, $0.35 below Monday’s close. Product prices also surged yesterday morning before heading down again.

Diesel opened at $1.6343/gallon in today’s session. This was a decrease of 1.27 cents (0.77%) below Monday’s opening price. Current prices are $1.621/gallon, down by 1.19 cents from yesterday’s closing price.

Gasoline opened at $1.7229/gallon today, a drop of 1.04 cents, or 0.6%, from yesterday’s opening. Prices are $1.7069/gallon currently, down by 1.27 cents from yesterday’s close.

The market appears to be downplaying geopolitical risk factors over North Korea’s recent failed ballistic missile test. For the moment, the U.S. is looking to China to pressure North Korea into backing down, and to eventually dismantling its nuclear weapons program. The administration has stated that it is considering all possible responses, emphasizing its recent willingness to use military force, and reportedly is sending a U.S. carrier strike group to the region.

Nonetheless, prices have eased, based partly on expanding supply in the U.S. and other non-OPEC countries. The EIA released its Drilling Productivity Report (DPR) yesterday, and the forecast calls for a significant jump in U.S. output in May. The DPR estimated production of 5069 kbpd in April, and forecasts production of 5193 kbpd in May, an increase of 124 kbpd. The largest increases are forecast for the Permian region (up by 76 kbpd) and the Eagle Ford region (up by 39 kbpd.)

Note: The EIA is experiencing technical difficulties that have delayed the release of gasoline and diesel retail price data. Our normally scheduled analysis will appear in tomorrow’s newsletter, pending data release.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.