Today’s Market Trend

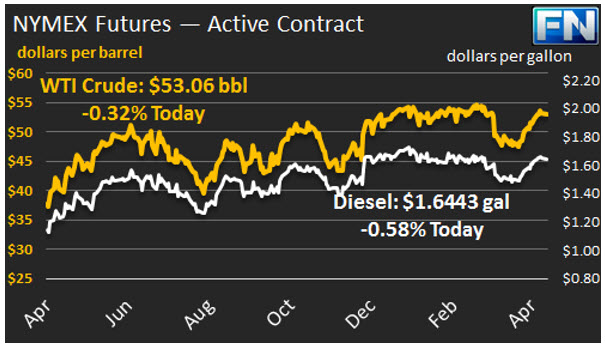

WTI crude prices are back above $53/b this morning, after a price retreat over the long weekend. WTI opened at $52.97/b today, an increase of $0.12 above Thursday’s opening price. Current prices are $53.06/b, $0.12 below Thursday’s close. Product prices also subsided Thursday and waned further over the weekend. Prices today are trending back up as buying interest revives.

Diesel opened at $1.647/gallon in today’s session. This was a decrease of 0.20 cents (0.12%) below Thursday’s opening price. Current prices are $1.6443/gallon, down 0.52 cents from Thursday’s closing price.

Gasoline opened at $1.7333/gallon today, a drop of 0.64 cents, or 0.37%, from yesterday’s opening. Prices are $1.7325/gallon currently, down 0.24 cents from Thursday’s close.

Markets were quiet before the Good Friday/Easter weekend. The oil complex had shown significant gains during the week, and the decline in prices is being attributed to profit taking. Crude and diesel still ended the week in the black, while gasoline prices dropped around a penny. Prices were supported by heightened geopolitical risk, now accentuated by North Korea’s unsuccessful ballistic missile test. The U.S. has brought pressure to bear on China to control North Korea. Adding strength to futures prices, the IEA projects an approaching balance between global supply and demand.

Working against this were EIA reports of continued expansion in U.S. crude production (an addition of 289 kbpd to domestic supply so far this year.) The Baker Hughes rig count report was released Friday, showing eight additional active rigs during the week ended April 14th. The active rig count has increased during every week except for one this year to date. Between the week ended January 6th and the week ended April 14th, 182 rigs have been activated, bringing the rig count to 847. The last time the rig count was this high was the week of September 11, 2015, nineteen months ago.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.