Today’s Market Trend

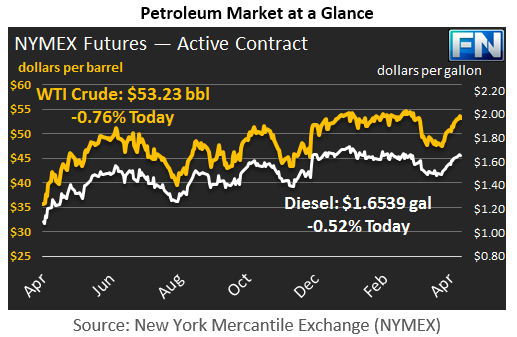

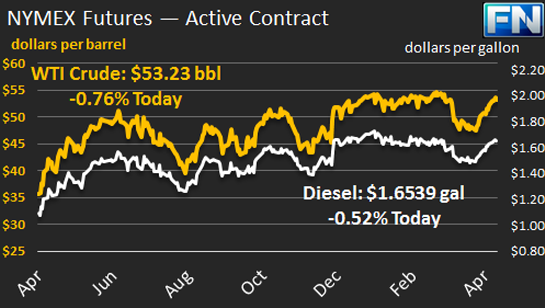

WTI crude prices are approximately $53.25/b this morning after easing below $53/b yesterday. WTI opened at $52.85/b today, a drop of $0.55 below yesterday’s opening. Current prices are $53.23/b, $0.12 above yesterday’s close. Product prices also subsided yesterday and are showing an uptick this morning, with diesel prices remaining more robust than gasoline prices.

Diesel opened at $1.649/gallon in today’s session. This was a decrease of 0.55 cents (0.33%) below yesterday’s opening price. Current prices are $1.6539/gallon, up 0.19 cents from yesterday’s close.

Gasoline opened at $1.7397/gallon today, a drop of 2.42 cents, or 1.37%, from yesterday’s opening. Prices are $1.7423/gallon currently, up fractionally by 0.06 cents from yesterday’s close.

Crude and product prices had been on a four-day rising streak until yesterday, when profit taking signaled that many traders felt the market was slightly oversold. This occurred despite the fact that the EIA data on crude and product inventories was even more bullish than earlier industry forecasts had foreseen. On Monday, prices strengthened when Schneider Electric’s survey indicated a crude drawdown of 1.0 mmbbls, a gasoline draw of 2.0 mmbbls, and a distillate draw of 1.5 mmbbls. On Tuesday, the API data series showed an even larger draw: 1.3 mmbbls of crude, 3.73 mmbbls gasoline, and 1.58 mmbbls of distillate. The official EIA data released yesterday now shows a crude drawdown of 2.166 mmbbls, a gasoline drawdown of 2.973 mmbbls, and a distillate drawdown of 2.153 mmbbls.

Mansfield Supply Bulletin: Florida State of Emergency

Mansfield would like to notify readers that wildfires in Florida prompted Governor Rick Scott to declare a state of emergency on Tuesday. More than 100 wildfires continue to burn. The largest active fire currently, known as the Cowbell fire, has burned nearly 25 square miles. The fires have not had an impact on fuel infrastructure, but the officially declared state of emergency triggers price gouging language. This could create legal ambiguities, potentially leading to temporary supplier disruption. Mansfield Oil will continue to monitor the situation and will keep customers informed.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.