Today’s Market Trend

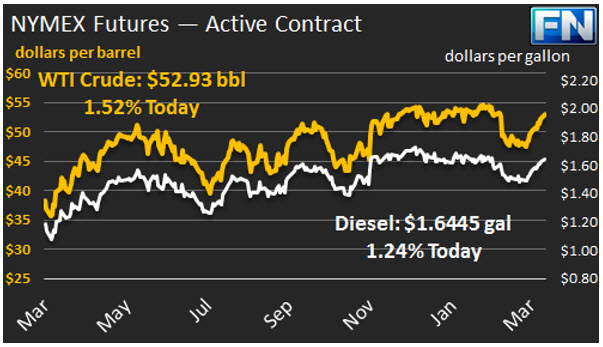

WTI crude prices are trending up this morning, and they are approaching the $53/b mark this morning. Prices surged last Friday in the aftermath of the U.S. missile strikes on Syria. WTI opened at $52.31/b today, an increase of $0.61 above Friday’s opening. Current prices are $52.93/b, $0.69 above Friday’s close. Product prices also have risen this morning.

Diesel opened at $1.6296/gallon in today’s trading session. This was an increase of 0.1.76 cents (1.09%) above Friday’s opening price. Current prices are $1.6445/gallon, up 1.61 cents from Friday’s close.

Gasoline opened at $1.7466/gallon today, an increase of 1.63 cents, or 0.94%, from Friday’s opening. Prices are $1.7575/gallon currently, up 1.13 cents from yesterday’s close. Gasoline prices are at their highest levels since mid-August of 2015.

Friday’s news included the U.S. Bureau of Labor Statistics (BLS) jobs report for March 2017. The BLS reported that non-farm payroll employment “edged up by 98,000,” whereas the forecast had been for 180,000 jobs. This was taken as a disappointment, and it overshadowed the news that U.S. unemployment rate dropped to 4.5% in March. This is the lowest unemployment rate since 2007, when rates were 4.5% in April and 4.4% in May.

Friday also brought the Baker Hughes active rig count numbers, showing another 15 rigs added (10 oil-oriented and 5 gas-oriented.) Since the end of December, 181 rigs have been added to the active count.

Any possible bearish impact of this news was overwhelmed by increased geopolitical tension. Not only is the situation in Syria reverberating, but Libya’s National Oil Company (NOC) declared force majeure once again on Sharara crude loadings at the Zawiya terminal. Production had only recently been restored, and reports now say that the pipeline has been blocked once again.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.