Nat Gas News – April 10 , 2017

Nat Gas News – April 10, 2017

In the News

Nuclear plant owners expand search for rescue to more states

The Orlando Sentinel reports: The natural gas boom that has hammered coal mines and driven down utility bills is hitting nuclear power plants, sending multi-billion-dollar energy companies in search of a financial rescue in states where competitive electricity markets have compounded the effect. Fresh off victories in Illinois and New York, the nuclear power industry is now pressing lawmakers in Connecticut, New Jersey, Ohio and Pennsylvania for action. Lobbying efforts are bubbling up into proposals, even as court battles in Illinois and New York crank up over the billions of dollars that ratepayers will otherwise foot in the coming decade to keep nuclear plants open longer. Perhaps nuclear power’s biggest nemesis is the cheap natural gas flooding the market from the northeast’s Marcellus Shale reservoir, the nation’s most prolific gas field. Meanwhile, electricity consumption hit a wall after the recession, while states have emphasized renewable energies and efficiency. For more visit orlandosentinel.com

Gov. Cuomo blocks northern access pipeline

NRDC reports: New York State just blocked the Northern Access Project, a pipeline that would have carried fracked gas from Pennsylvania to Canada via New York. This is a huge victory not just for New Yorkers but for the entire planet. On March 7, 2017, the New York State Department of Environmental Conservation (DEC), after a careful and exhaustive study, exercised its right under Section 401 of the federal Clean Water Act to deny certification to the proposed 24-inch diameter, 99-mile pipeline. Without 401 certification, the natural gas pipeline cannot go forward within the state. For more on this story visit nrdc.org or click the following link http://on.nrdc.org/2nYr8QV

This article is part of Daily Natural Gas Newsletter

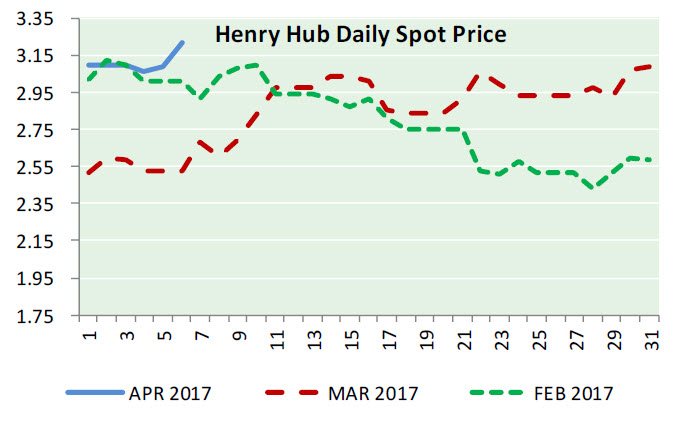

Tagged: natural gas, pricing

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.