Retail Gasoline and Diesel Prices Slump, then Recover, in the First Quarter 2017

Retail Prices Slump, Then Recover by Quarter’s End

The beginning of the first quarter brought exceptionally strong gasoline and diesel retail prices. The market expected that the OPEC-NOPEC crude oil production cuts would start whittling away at the burgeoning stockpiles that had suppressed prices. OPEC achieved high levels of compliance with the production cut agreement, but the impact on global stockpiles has been slower than many expected. Also, U.S. crude producers took the opportunity to raise domestic output. U.S. stockpiles continued to grow. This placed downward pressure on prices.

This article provides a review of gasoline and diesel retail prices during the first quarter, based on the weekly prices provided by the U.S. Energy Information Administration (EIA.) The data includes the week ended April 3rd, to cover the entirety of the quarter.

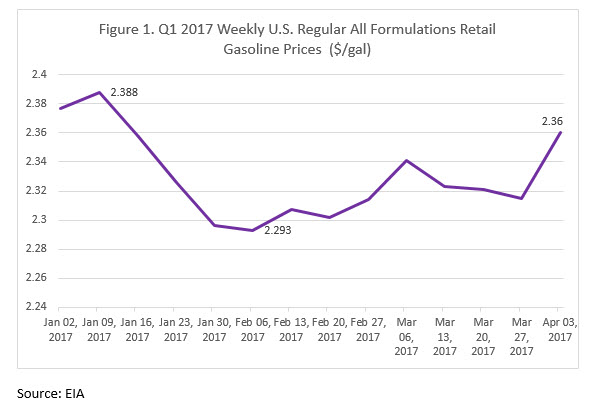

As Figure 1 shows, U.S. retail gasoline prices started out Q1 at approximately $2.38/gallon. Prices sagged to around $2.30/gallon by the end of January, and they remained roughly flat in February. By March, many refineries entered into their Spring maintenance cycles, and U.S. gasoline inventories were drawn down every week since the middle of February. Gasoline prices began to recover. For the week ended April 3rd, 2017, gasoline retail prices averaged $2.36/gallon.

U.S. retail prices for diesel also started Q1 at high levels, approximately $2.59/gallon in early January. Like gasoline, diesel prices declined by the end of January. Diesel prices were rangebound in February at $2.56-2.58/gallon. Unlike gasoline, however, diesel prices slumped in March, falling to $2.532/gallon during the week ended March 27th. This price weakness emerged despite the fact that U.S. diesel inventories were drawn down steadily in March. A recent price rally brought crude prices back above $50/b, and diesel prices responded to this upward trend. For the week ended April 3rd, diesel prices rose to $2.556/gallon.

Gasoline and Diesel Retail Prices show Enormous Year-on-Year Rise

Although gasoline and diesel retail prices weakened in the middle of the quarter, they have risen enormously when compared to last year. Figure 3 shows the increase in U.S. retail gasoline prices as of the week ended April 3rd, 2017, relative to the week ended April 3rd, 2016. At the national level, gasoline prices were 27.7 cents per gallon higher at the end of Q1 2017 than they were at the end of Q1 2016.

At the PADD level, the largest price hike has occurred in PADD 4, the Rocky Mountains market, where gasoline prices rose by 32.8 cents/gallon over the past year. Prices in PADD 1, the East Coast market, rose by 27.0 cents/gallon. The Midwest PADD 2 market experienced a price increase of 29.1 cents/gallon. PADD 3, the Gulf Coast market, prices rose 25.5 cents/gallon. In the PADD 5 West Coast market, gasoline prices were 27.3 cents/gallon higher.

Retail prices for diesel have risen even more quickly than gasoline prices. At the national level, diesel prices surged 44.1 cents/gallon higher at the end of Q1 2017 relative to prices at the end of Q1 2016. The PADD 5 West Coast market experienced the largest price hike at 52.2 cents/gallon higher. Prices rose by 50 cents/gallon in the Rocky Mountains PADD 4 market. In the East Coast PADD 1, market, diesel prices rose 42.6 cents/gallon. Prices rose 41.6 cents/gallon in the Midwest PADD 2 market. The Gulf Coast PADD 3 saw diesel prices rise 43.1 cents/gallon.

Conclusion: Mid-Quarter Retail Price Weakness Following Crude Strength

During the first quarter of 2017, therefore, gasoline and diesel retail prices started out strong, buoyed by the optimism of the OPEC-NOPEC crude production cuts. WTI crude started the quarter at over $54/b. But prices weakened during the quarter, sinking below $50/b in April, and product prices weakened as well. By the end of the quarter, crude prices rallied and regained the $50/b mark. Gasoline and diesel retail prices are showing an uptick in response. The OPEC-NOPEC production cuts are expected to continue through the second quarter, and OPEC is contemplating a six-month extension that would carry the cuts through the end on 2017. If crude prices reach the $55-60/b levels many financial houses now predict, retail prices should continue to strengthen. As a caveat, however, U.S. crude production is rising, which may dampen prices. In all cases, however, gasoline and diesel retail prices in all PADDs were significantly above their levels from the first quarter of 2016. At the national level, gasoline prices were 27.7 cents/gallon higher, and diesel prices were 44.1 cents/gallon higher.

This article is part of Diesel

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.