EIA Gasoline and Diesel Retail Prices Update

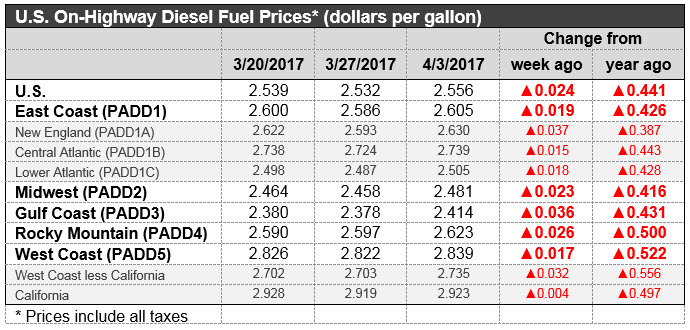

The Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended April 3rd, 2017. Prices for both fuels rose during the week, following crude prices up.

For the current week ended April 3rd, diesel prices rose by 2.4 cents to an average price of $2.556/gallon.

PADD 1 retail diesel prices increased 1.9 cents to $2.605/gallon. New England prices rose 3.7 cents to $2.63/gallon. Central Atlantic diesel prices rose by 1.5 cents to average $2.739/gallon. Lower Atlantic prices increased by 1.8 cents to average $2.505/gallon. Overall PADD 1 prices were 42.6cts/gallon above their prices for the same week last year. PBF Energy will be shutting a 46 kbpd diesel hydrotreater at its 160 kbpd Paulsboro, New Jersey, refinery, for a three- to four-week maintenance period. Phillips 66’s 238 kbpd Bayway, New Jersey, refinery, was running at very low throughput. It was scheduled to restart in mid-March, including its crude unit, its 145 kbpd cat cracker, its cat reformer, and its diesel hydrotreater. But delays pushed back the restart until the 31st.

In the Midwest PADD 2 market, retail diesel prices increased 2.3 cents to average $2.481/gallon. This price was 41.6 cents/gallon above its level for the same week last year. Tesoro was forced to on Friday to close its 75 kbpd Mandan, North Dakota, refinery for a full-plant overhaul, which had been originally scheduled for April 4th. The overhaul includes a diesel hydrotreater. HollyFrontier completed maintenance at its 140 kbpd refinery at El Dorado, Kansas. Valero’s 190 kbpd Memphis, Tennessee, refinery has been running at low throughput because of the closure of Marathon Pipeline’s Capline.

In the Gulf Coast PADD 3, retail diesel prices rose 3.6 cents to $2.414/gallon. This price was 43.1cts higher than in the previous year. Shell announced that it would close the 60 kbpd hydrocracker at its 340 kbpd Deer Park, Texas refinery for a planned overhaul. Motiva announced that it would be shutting down its hydrocracker and cutting crude runs at its 230 kbpd Convent, Louisiana, refinery, for a period of around four weeks. This is to finalize repairs on a fire-damaged section that has been closed since August. HollyFrontier’s 100 kbpd refinery in Artesia, New Mexico, is down for maintenance, as is Marathon Petroleum’s 84 kbpd Texas City refinery and Valero’s 95 kbpd refinery at Three Rivers, Texas. ExxonMobil shut down the 29.5 kbpd hydrocracker on Wednesday at its 600 kbpd Baytown, Texas refinery to repair a leak. The same hydrocracker is scheduled for maintenance in late-May/early June.

In the Rocky Mountains PADD 4 market, retail diesel prices increased 2.6 cents to $2.623/gallon. This price was 50.0 cents higher than in the prior year. Suncor’s 103 kbpd refinery at Commerce City, Colorado, has been closed because of a full-plant power failure.

In the West Coast PADD 5 market, diesel pump prices increased by 1.7 cents to average $2.839/gallon. This price was 52.2 cents above its level last year. Prices excluding California rose 3.2 cents to $2.735/gallon, which was 55.6 cents above the retail price for the same week last year. California diesel prices edged up only slightly, by 0.4cts to an average price of $2.923/gallon, 49.7cts higher than last year’s price. Prices were influenced by downtime at one of the hydrocrackers (20 kbpd capacity) at the 77 kbpd Phillips 66 Rodeo refinery near San Francisco. Phillips 66’s 100-kbpd refinery at Ferndale, Washington was down for an overhaul. PBF Energy reduced throughput at the 88 kbpd VGO hydrotreater at its 149 kbpd Torrance, California, refinery, for more unplanned repairs. This unit is scheduled for a seven-week overhaul in late April/Early May. The hydrocracker is scheduled for a five-week overhaul.

US retail gasoline prices rose significantly by 4.5 cents for the week ended April 3rd, to $2.360/gallon. This price was 27.7 cents higher than for the same week in 2016.

In the East Coast PADD 1, prices for gasoline increased by 2.7 cents to $2.303/gallon. This price was 27.0cts higher than last year’s price. Prices increased by 2.7 cents in New England to $2.29/gallon. Central Atlantic market prices rose by 2.8 cents to $2.40/gallon. Prices in the Lower Atlantic market rose by 2.8 cents, to bring prices to an average of $2.235/gallon, 23.8 cents higher than last year’s average price. Philadelphia Energy Solutions shut the 6 kbpd alkylation unit at its Point Breeze, Philadelphia, refinery for unplanned repairs.

In the Midwest PADD 2 market, gasoline prices were hiked by 9.5 cents to average $2.279/gallon. Gasoline pump prices were 29.1 cents higher than they were one year ago. Tesoro was forced to on Friday to close its 75 kbpd Mandan, North Dakota, refinery for a full-plant overhaul after a power outage and steam plant failure. The refinery includes a cat cracker and a cat reformer. The overhaul was originally scheduled for April 4th. Valero’s 190 kbpd Memphis, Tennessee, refinery has been running at low throughput because of the closure of Marathon Pipeline’s Capline, closed since March 28th. Marathon will attempt to re-open the line next week.

In the Gulf Coast PADD 3 market, gasoline prices rose 3.7 cents to average $2.124/gallon. Prices for the week were 25.5 cents higher than for the same week in 2016. LyondellBasell’s Houston refinery continues to work on repairs to the cooling unit at its 110 kbpd cat cracker, which was seriously damaged by a fire. This unit is likely to be out of commission until the middle of April. Total resumed operation of the 80 kbpd cat cracker at its 240 kbpd refinery in Port Arthur, Texas. Citgo is continuing maintenance at its Lake Charles, Louisiana refinery, scheduled for completion in early April.

The Rocky Mountains PADD 4 region was the only PADD where gasoline prices eased slightly during the week, declining 0.6 cents to average $2.297/gallon. This price was 32.8 cents higher than at the same time in 2016. Suncor’s 103 kbpd Commerce City, Colorado, refinery had been delayed in restarting after a March 11th power outage.

In the West Coast PADD 5 market, retail gasoline prices increased 0.5 cents to an average price of $2.853/gallon. This was 27.3 cents higher than at the same time a year ago. Excluding California, prices rose by 2.4 cents to an average of $2.614/gallon. This was 37.2 cents higher than at the same time in 2016. In California, prices decreased 0.6 cents to an average pump price of $2.992/gallon. Prices were 21.6 cents higher than last year’s price for the same week. Los Angeles prices dropped by 1.5 cents to average $3.013/gallon. San Francisco pump prices increased by 0.8 cents to average $3.053/gallon, 25.3 cents above last year’s price. Seattle prices rose 3.1 cents to average $2.848/gallon, 51.0cts higher than prices one year ago. Phillips 66’s 100-kbpd refinery at Ferndale, Washington was down for an overhaul, with a restart planned for next week. PBF Energy’s 149 kbpd Torrance refinery ran at reduced throughput again after trouble at its VGO hydrotreater, which resulted in heavy flaring. The unit is scheduled for seven weeks maintenance in late April-early May, during which time the FCC will be run at reduced rates, constraining gasoline output. Chevron’s El Segundo refinery came back onstream.

This article is part of Diesel

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.