Today’s Market Trend

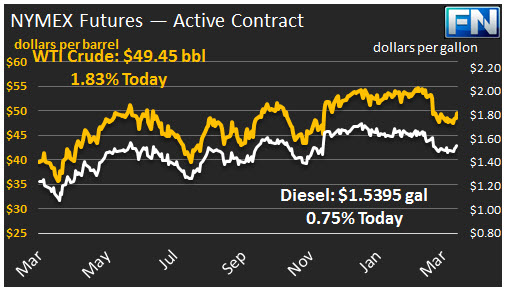

WTI crude prices have climbed back to nearly $48.50/b this morning, opening at their highest level in three week. WTI opened at $49.60/b today, a major jump of $1.13, or 2.33%, above yesterday’s opening price. Prices are $49.45/b currently, down $0.06 from yesterday’s close. Already this session, WTI prices have gone as high as $49.94/b. Product prices also continued to appreciate yesterday and remained strong overnight.

Diesel opened at $1.546/gallon in today’s session. This was an increase of 2.44 cents (1.6%) above yesterday’s opening price. Current prices are $1.5395/gallon, down 0.3 cents from yesterday’s close.

Gasoline opened at $1.67/gallon today, a jump of 3.9 cents, or 2.39%, from yesterday’s opening. Prices are $1.6695/gallon currently, down 0.25 cents from yesterday’s close.

U.S. crude oil inventories rose once again during the week ended March 24th, but this time, the build was relatively small, and it was more than offset by large product drawdowns. The EIA reported that crude inventories rose by 0.867 mmbbls, whilst gasoline inventories were drawn down by 3.747 mmbbls and diesel inventories were drawn down by 2.483 mmbbls. The inventory movements were significantly more constructive than expected by the market. Earlier, API’s weekly figures had shown a crude build of 1.91 mmbbls, a gasoline inventory drawdown of 1.1 mmbbls, and a diesel drawdown of 2.04 mmbbls. The API numbers added to a net drawdown of 1.23 mmbbls of crude plus product. In contrast, the EIA data showed a net drawdown of 5.363 mmbbls of crude plus product.

The smaller-than-expected addition to crude stocks was aided by a weekly jump in crude exports, which averaged 1.01 mmbpd for the week, as compared to 0.55 mmbpd the week prior. Crude imports remained roughly stable (a small decrease of 0.083 mmbpd.) A number of refineries have completed spring maintenance, which contributed to a jump in crude runs of 425 kbpd on average for the week. Weekly average fuel demand also rose significantly: gasoline demand was up 324 kbpd, jet fuel demand was up 153 kbpd, and diesel demand was up 210 kbpd. Overall, the weekly data was a bullish set.

Capline Shutdown in Louisiana: Marathon Pipe Line LLC, the operator of the 650-mile Capline system, closed the line on Tuesday after detecting an anomaly on the line in Louisiana. Local supply issues are possible. Valero has cut utilization at its 190 kbpd Memphis, Tennessee refinery. This refinery receives the majority of its crude via pipeline, though some barge deliveries are possible as well.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.