Nat Gas News – March 21, 2017

Nat Gas News – March 21, 2017

In the News

Cheniere Gets Commitments Proposed STACK/SCOOP-to-Gulf Coast Gas Pipeline

Houston Business Journal reports: Cheniere Energy Inc. (NYSE MKT: LNG) already has enough commitments to take the next steps in its development of the Midship Pipeline project, but the company has decided to hold an open season to gather binding commitments beyond that. The pipeline would move about 1.4 million dekatherms per day of natural gas out of the SCOOP and STACK production areas in Oklahoma and into markets along the U.S. Gulf Coast. For more on this story visit bizjournals.com/houston or click http://bit.ly/2nhJrCP

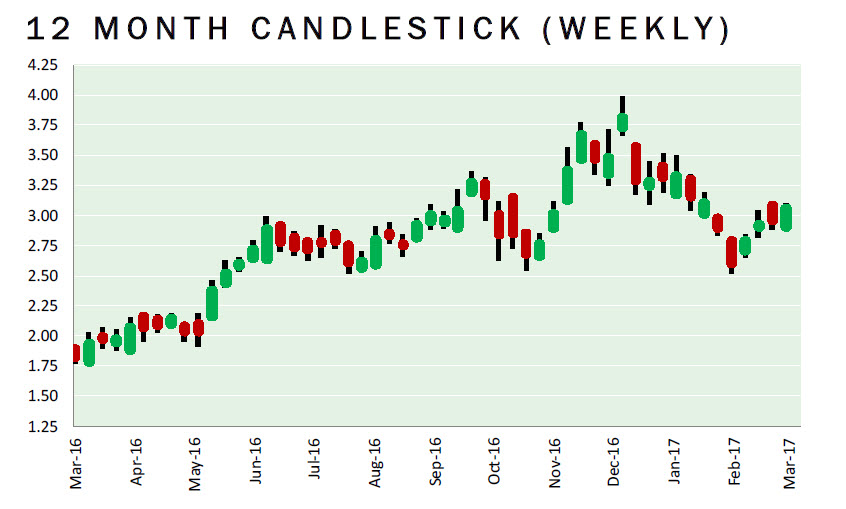

U.S. natural gas futures rise back toward $3

Investing.com reports: U.S. natural gas futures extended gains to a second session on Monday, as forecasts showing cooler weather on the way boosted the heating fuel. Cool temperatures will sweep across the Great Lakes and eastern U.S. toward the middle of the week, according to forecasters at NatGasWeather.com, with overnight lows expected to drop well below freezing. Temperatures are expected to remain much colder than normal through the end of the week, with highs struggling to reach the 30s, while overnight lows drop into the teens to below 0F. A fast-moving weather system will then impact the east-central U.S. Saturday into Sunday, followed by warming Monday, but again cooling off mid-week. For more, visit investing.com or click http://bit.ly/2nG7xsj

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.